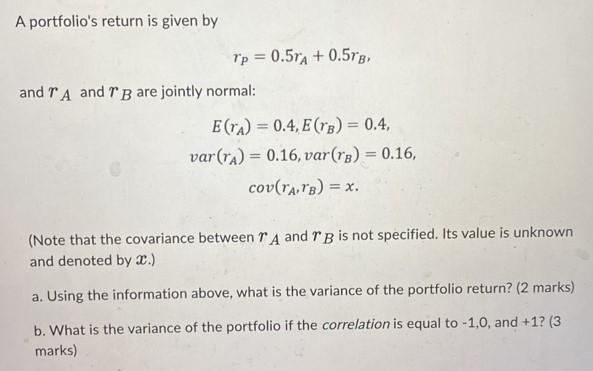

Question: A portfolio's return is given by T'p = 0.5%A + 0.5TB, and A and B are jointly normal: E(TA) = 0.4, E(TB) = 0.4,

A portfolio's return is given by T'p = 0.5%A + 0.5TB, and A and B are jointly normal: E(TA) = 0.4, E(TB) = 0.4, var (ra) 0.16, var (rg) = 0.16, COV(TA,TB) = x. (Note that the covariance between 7A and TB is not specified. Its value is unknown and denoted by C.) a. Using the information above, what is the variance of the portfolio return? (2 marks) b. What is the variance of the portfolio if the correlation is equal to -1,0, and +1? (3 marks)

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Answer a Variance of the portfol... View full answer

Get step-by-step solutions from verified subject matter experts