Question: A potential new project would cost $3000 today. The project would last 2 years. There are 3 possible scenarios for net cash flows in years

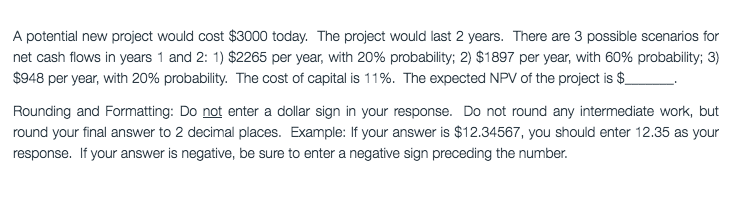

A potential new project would cost $3000 today. The project would last 2 years. There are 3 possible scenarios for net cash flows in years 1 and 2: $2265 Per year, with 20% probability; $1897 per year, with 60% probability; $948 per year, with 20% probability. The cost of capital is 11%. The expected NPV of the project is $ ____. Rounding and Formatting: Do not enter a dollar sign in your response. Do not round any intermediate work, but round your final answer to 2 decimal places. Example: If your answer is $12.34537, you should enter 12.35 as your response. If your answer is negative, be sure to enter a negative sign preceding the number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts