Question: A power-producing unit has installed a new computer to control one of its units. a) For a 5-year property class, what would the deprecation percentage

A power-producing unit has installed a new computer to control one of its units.

a) For a 5-year property class, what would the deprecation percentage be for the third year after the installation when using MACRS ( GDS)?

b) Rework

c) using the MACRS depreciation method ( assume three-year property class) instead of the SL depreciation method.

A power producing unit has installed a new computer to control one of its units. a. For a 5-year property class, what would the deprciation percentage be for the third year after the installation when using MACRS (GDS) b. Rework the question using the MACRS depreciation method (assume three-year property class) instead of the SL depreciation method.

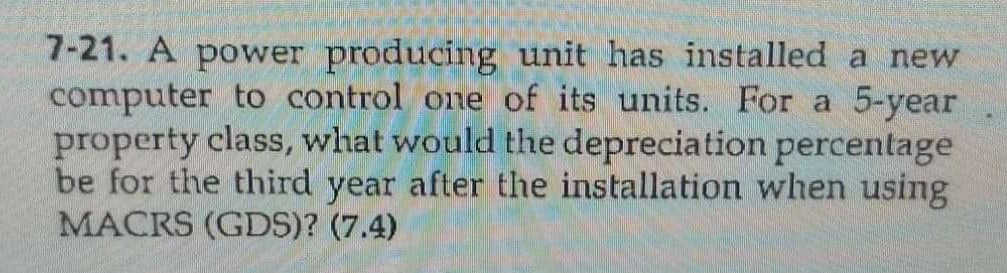

7-21. A power producing unit has installed a new computer to control one of its units. For a 5-year property class, what would the depreciation percentage be for the third year after the installation when using MACRS (GDS)? (7.4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts