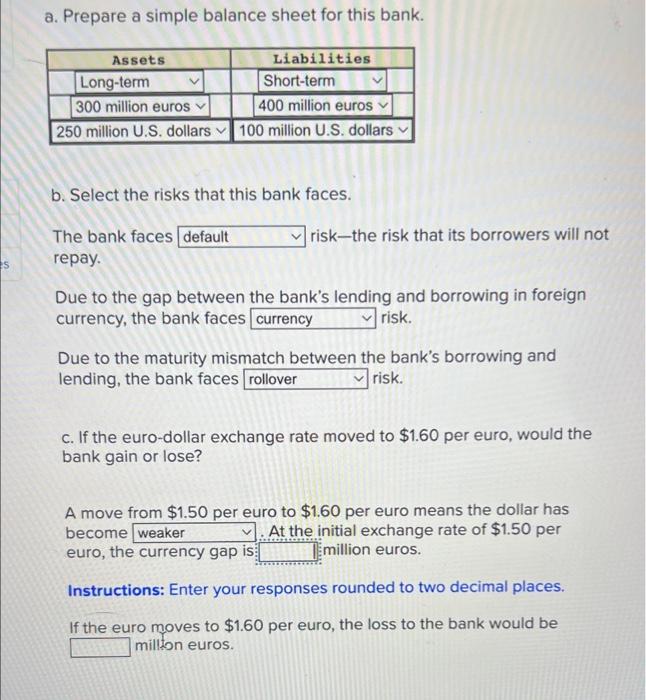

Question: a. Prepare a simple balance sheet for this bank. b. Select the risks that this bank faces. The bank faces risk-the risk that its borrowers

a. Prepare a simple balance sheet for this bank. b. Select the risks that this bank faces. The bank faces risk-the risk that its borrowers will not repay. Due to the gap between the bank's lending and borrowing in foreign currency, the bank faces risk. Due to the maturity mismatch between the bank's borrowing and lending, the bank faces risk. c. If the euro-dollar exchange rate moved to $1.60 per euro, would the bank gain or lose? A move from $1.50 per euro to $1.60 per euro means the dollar has become . At the initial exchange rate of $1.50 per euro, the currency gap is: million euros. Instructions: Enter your responses rounded to two decimal places. If the euro moves to $1.60 per euro, the loss to the bank would be millon euros

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts