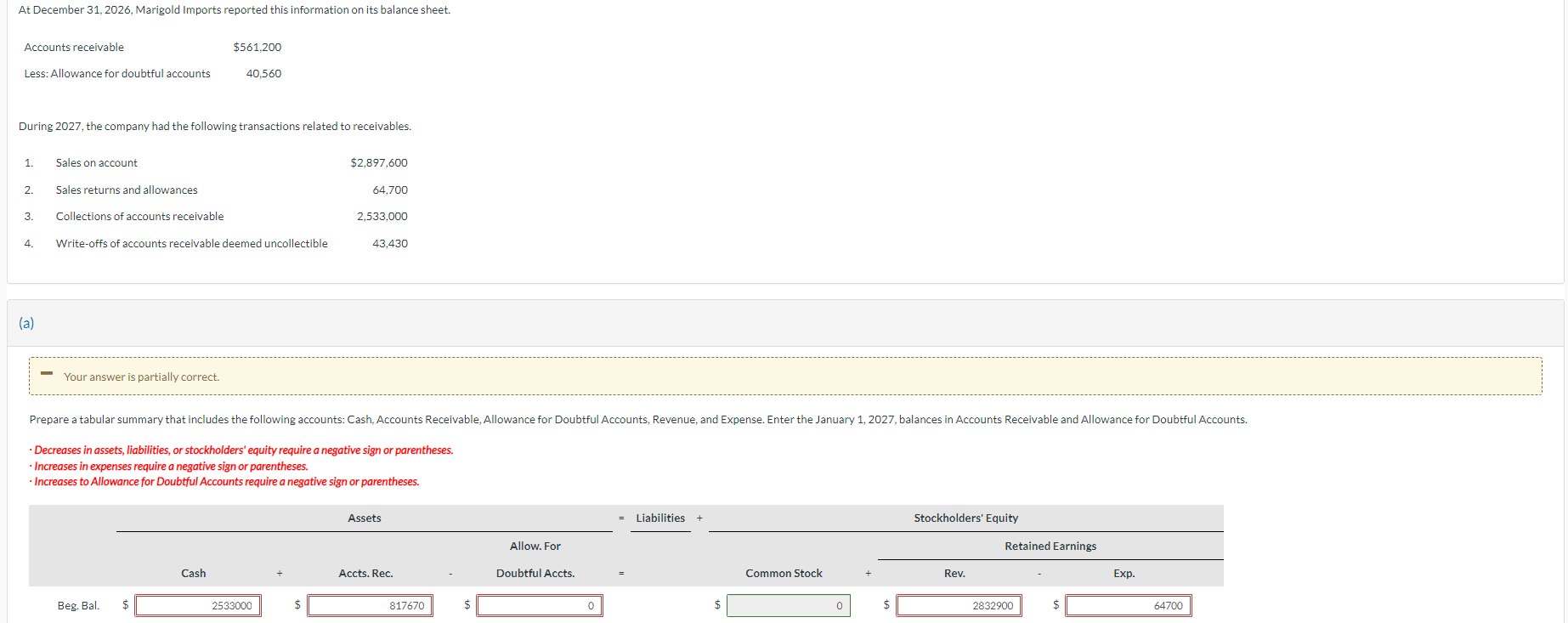

Question: a) Prepare a tabular summary that includes the following accounts: Cash, Accounts Receivable, Allowance for Doubtful Accounts, Revenue, and Expense. Enter the January 1, 2027,

a) Prepare a tabular summary that includes the following accounts: Cash, Accounts Receivable, Allowance for Doubtful Accounts, Revenue, and Expense. Enter the January 1, 2027, balances in Accounts Receivable and Allowance for Doubtful Accounts.

b) Record transactions 1 through 4. (Omit recording cost of goods sold.)

c) Record bad debt expense for 2027, assuming that aging the accounts receivable indicates that estimated bad debts are $46,000.

d) Indicate how accounts receivable and the allowance for doubtful accounts will be reported on the December 31, 2027, balance sheet.

Analyze transactions related to bad debt expense.

At December 31, 2026, Marigold Imports reported this information on its balance sheet. During 2027, the company had the following transactions related to receivables. (a) - Your answer is partially correct. - Decreases in assets, liabilities, or stockholders' equity require a negative sign or parentheses. - Increases in expenses require a negative sign or parentheses. - Increases to Allowance for Doubtful Accounts require a negative sign or parentheses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts