Question: a. Prepare Business combination valuation entry, pre acquisition entry, NCI shares of equity 01/07/19, NCI shares of equity from 01/07/19 - 30/06/20 and NCI shares

a. Prepare Business combination valuation entry, pre acquisition entry, NCI shares of equity 01/07/19, NCI shares of equity from 01/07/19 - 30/06/20 and NCI shares equity 01/07/20 - 30/06/21

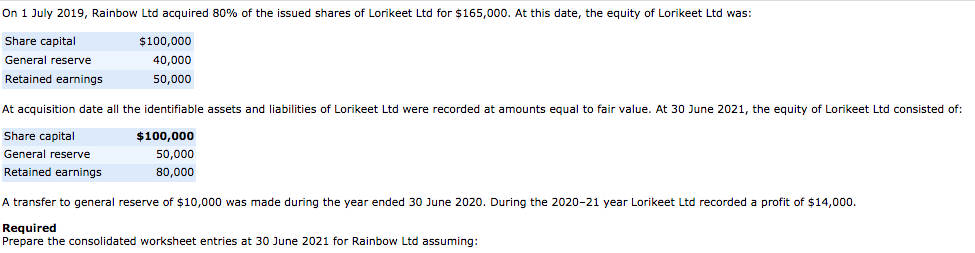

On 1 July 2019, Rainbow Ltd acquired 80% of the issued shares of Lorikeet Ltd for $165,000. At this date, the equity of Lorikeet Ltd was: Share capital General reserve Retained earnings $100,000 40,000 50,000 At acquisition date all the identifiable assets and liabilities of Lorikeet Ltd were recorded at amounts equal to fair value. At 30 June 2021, the equity of Lorikeet Ltd consisted of: Share capital General reserve Retained earnings $100,000 50,000 80,000 A transfer to general reserve of $10,000 was made during the year ended 30 June 2020. During the 2020-21 year Lorikeet Ltd recorded a profit of $14,000. Required Prepare the consolidated worksheet entries at 30 June 2021 for Rainbow Ltd assuming

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts