Question: a) Prepare journal entries until December 31, 2017 b) Prepare the journal entries until December 31, 2019, and explain all concepts in detail. On January

a) Prepare journal entries until December 31, 2017

b) Prepare the journal entries until December 31, 2019, and explain all concepts in detail.

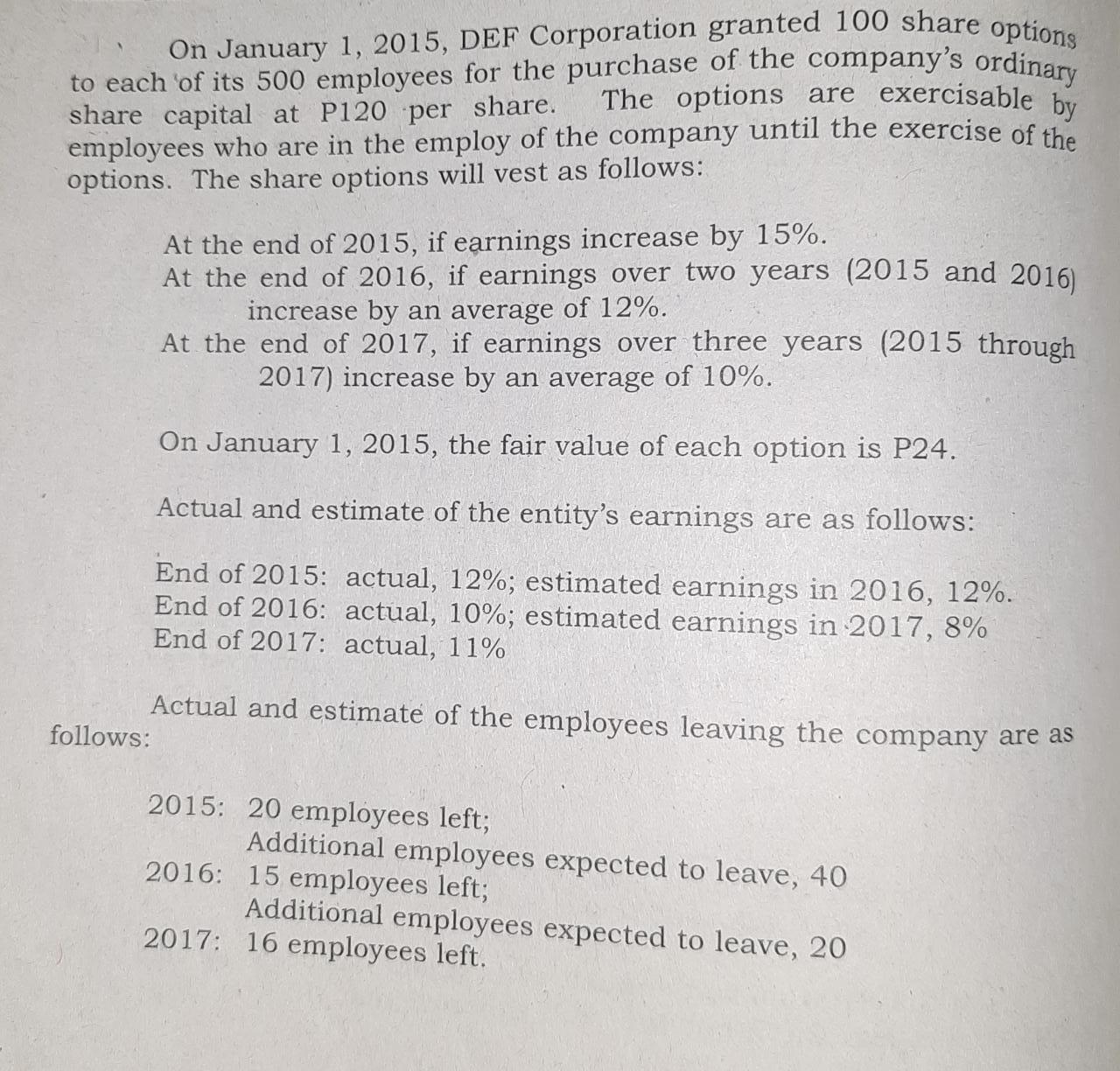

On January 1, 2015, DEF Corporation granted 100 share options to each of its 500 employees for the purchase of the company's ordinary share. The options are exercisable by share capital at P120 per employees who are in the employ of the company until the exercise of the options. The share options will vest as follows: follows: At the end of 2015, if earnings increase by 15%. At the end of 2016, if earnings over two years (2015 and 2016) increase by an average of 12%. At the end of 2017, if earnings over three years (2015 through 2017) increase by an average of 10%. On January 1, 2015, the fair value of each option is P24. Actual and estimate of the entity's earnings are as follows: End of 2015: actual, 12%; estimated earnings in 2016, 12%. End of 2016: actual, 10%; estimated earnings in 2017, 8% End of 2017: actual, 11% Actual and estimate of the employees leaving the company are as 2015: 20 employees left; 2016: 2017: 16 employees left. Additional employees expected to leave, 40 15 employees left; Additional employees expected to leave, 20

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

a Prepare journal entries until December 31 2017 On January 1 2015 Dr Share Option Expense 100 500 P24 P1200000 Cr Share Options Liability P1200000 At ... View full answer

Get step-by-step solutions from verified subject matter experts