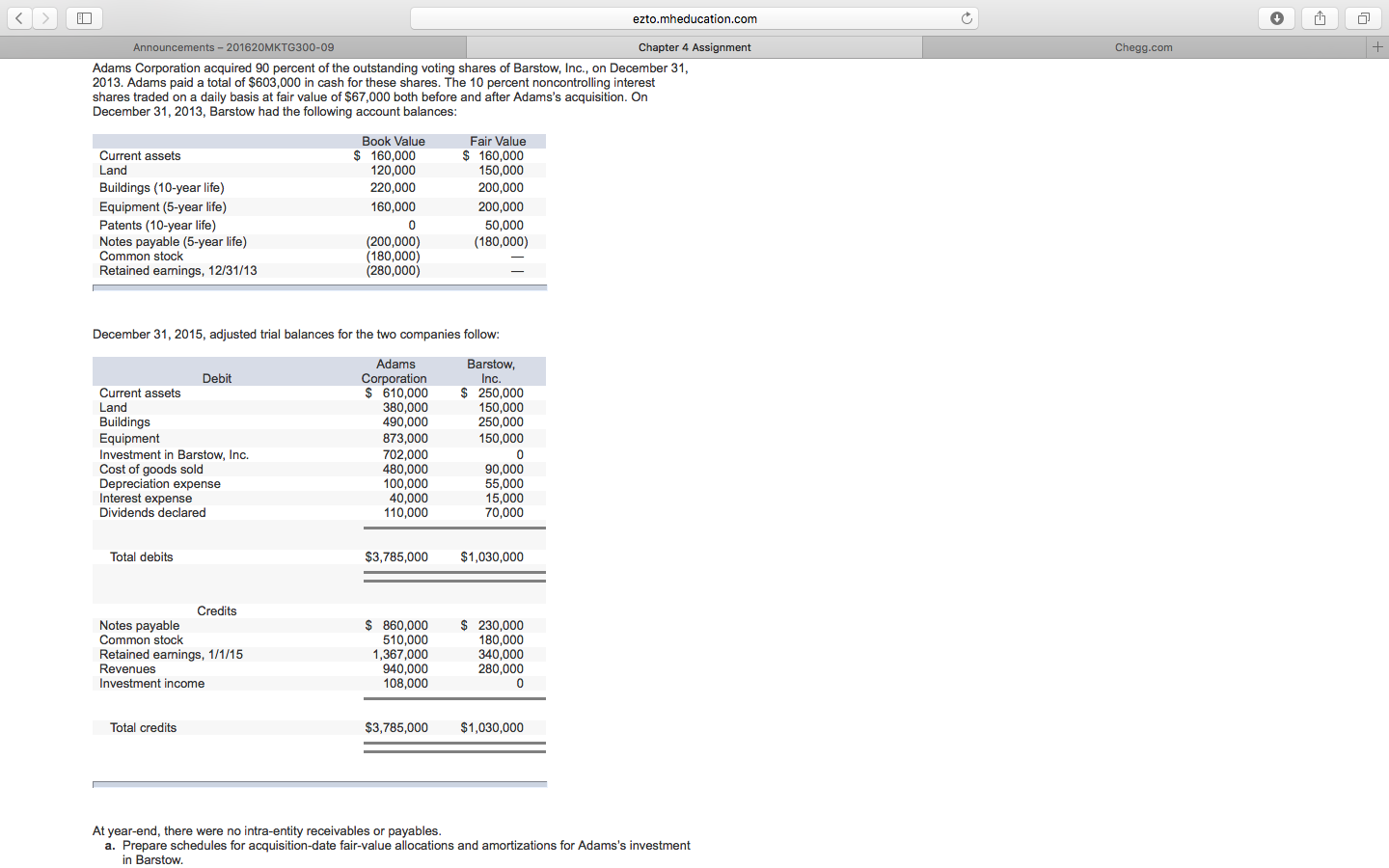

Question: a. Prepare schedules for acquisition-date fair-value allocations and amortizations for Adam's investment in Barstow. Annual excess amortizations = b. Determine Adam's method of accounting for

a. Prepare schedules for acquisition-date fair-value allocations and amortizations for Adam's investment in Barstow. Annual excess amortizations =

a. Prepare schedules for acquisition-date fair-value allocations and amortizations for Adam's investment in Barstow. Annual excess amortizations =

b. Determine Adam's method of accounting for its investment in Barstow. Adam's method of accounting for its investment in Barstow =

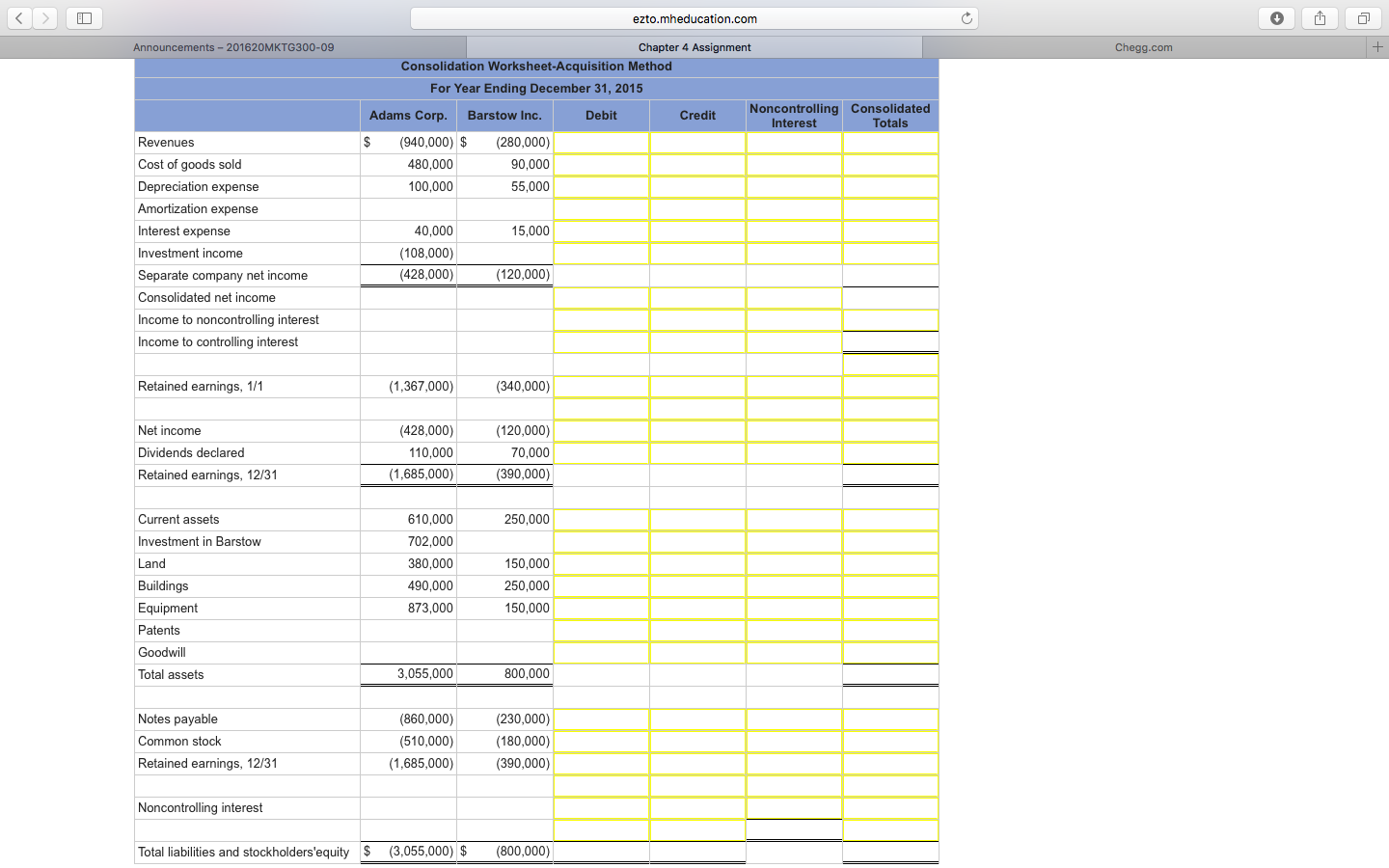

c. Prepare a consolidation worksheet for Adams Corporation and Barstow, Inc., as of December 31, 2015. (For accounts where multiple consolidation entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts