Question: (a) Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts include: Depreciation Expense, Insurance Expense, Interest Payable, and

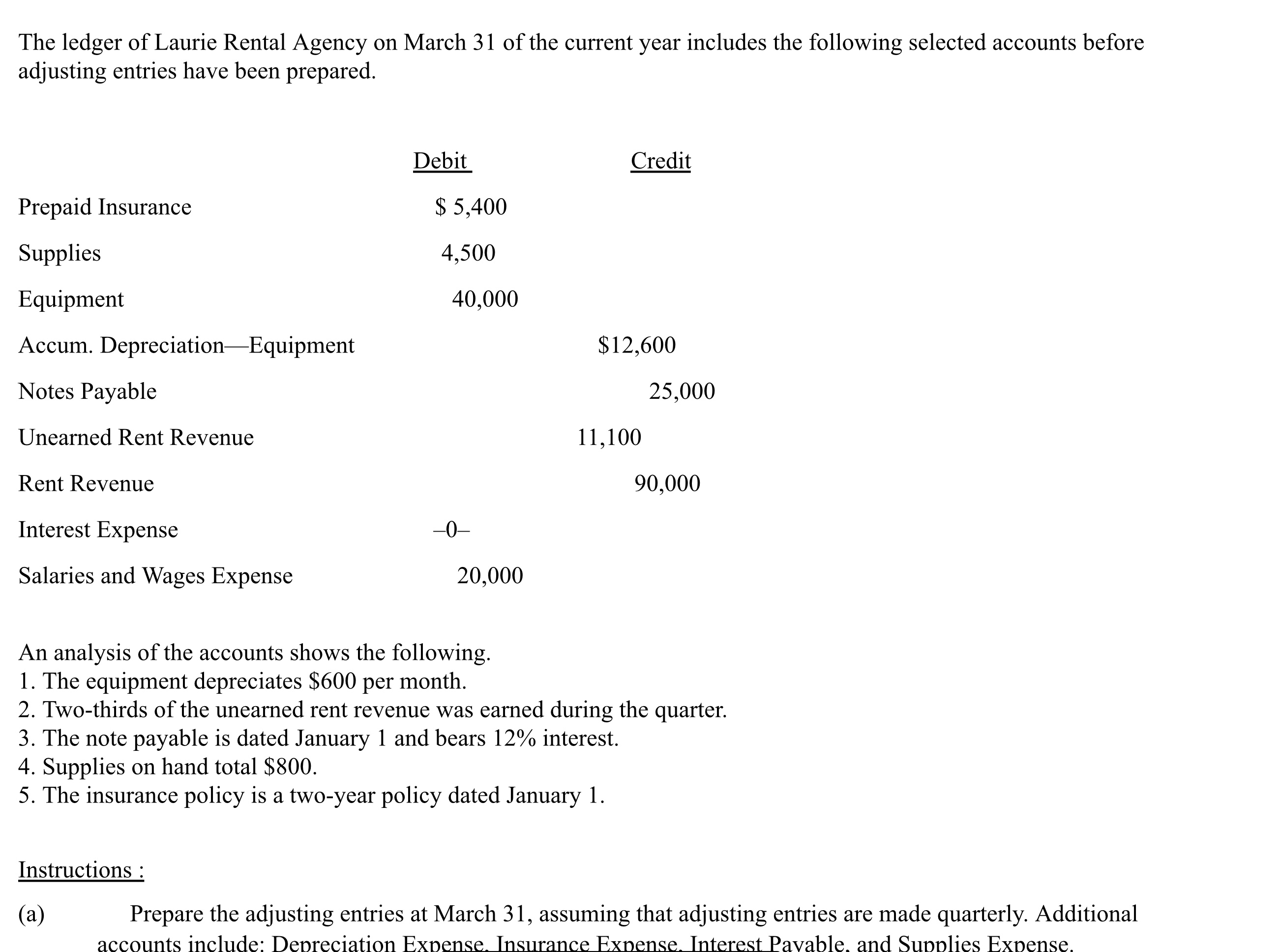

(a) Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts include: Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expense. (b) Compute the ending balances for Prepaid Insurance, Unearned Rent Revenue, and Rent Revenue, and indicate The ledger of Laurie Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. An analysis of the accounts shows the following. 1. The equipment depreciates $600 per month. 2. Two-thirds of the unearned rent revenue was earned during the quarter. 3. The note payable is dated January 1 and bears 12% interest. 4. Supplies on hand total $800. 5. The insurance policy is a two-year policy dated January 1. Instructions : (a) Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts include: Depreciation Expense. Insurance Exnense. Interest Pavable and Supplies Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts