Question: a . Present both the direct and the indirect exchange rates for the rupees for the three dates of ( 1 ) January 1 ,

a Present both the direct and the indirect exchange rates for the rupees for the three dates of January X; December X; and December X

b Prepare the subsidiarys translated balance sheet as of December X assuming the rupee is the subsidiarys functional currency. Focus on how to obtain the correct amount for RE Retained earnings?

c Prepare the subsidiarys translated balance sheet as of December X assuming the rupee is the subsidiarys functional currency.

d Compute the amount that Xs other comprehensive income would include as a result of the translation Complete this question by entering your answers in the tabs below.

Required A

Required B

Required C

Required D

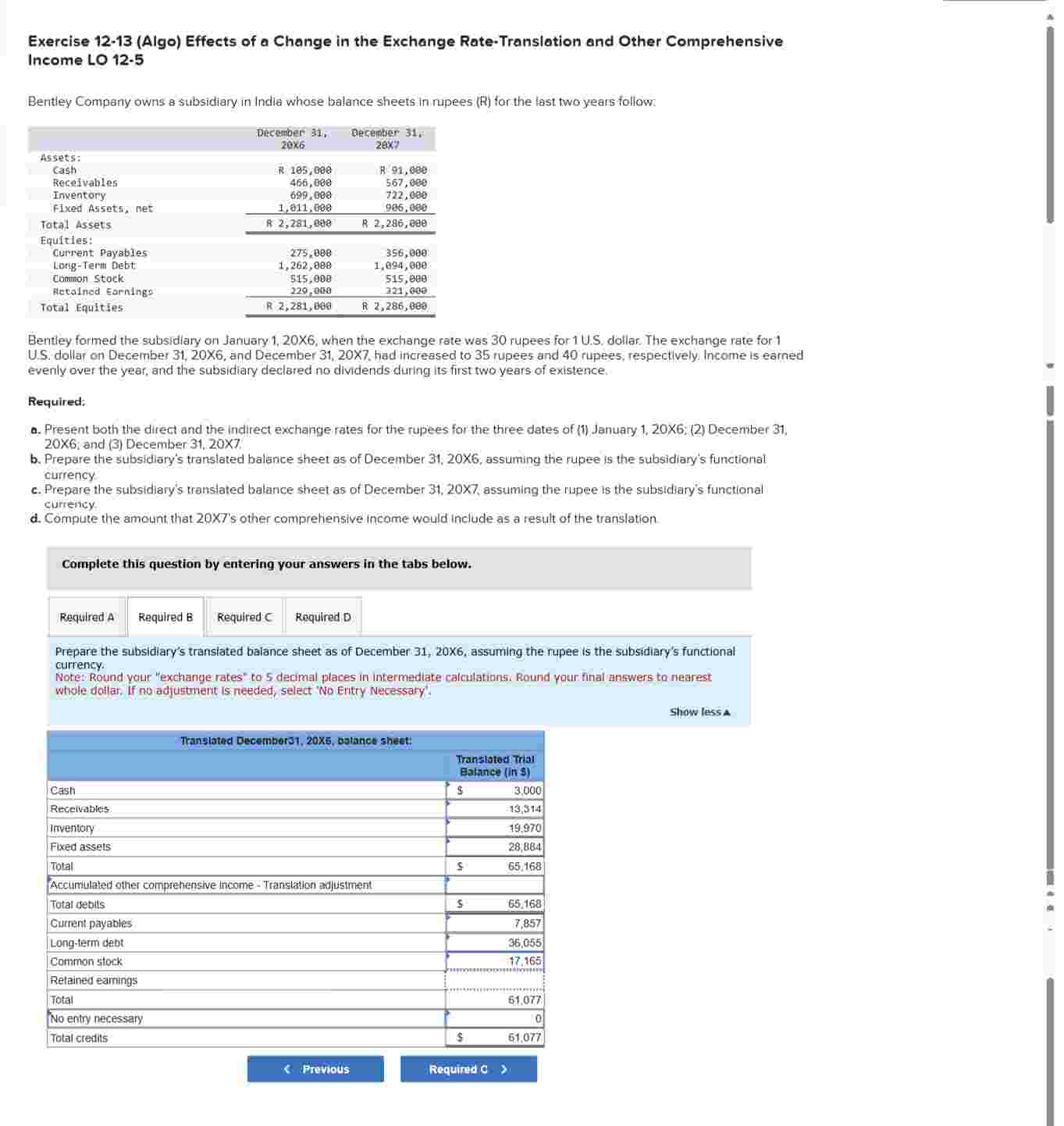

Prepare the subsidiary's translated balance sheet as of December X assuming the rupee is the subsidiary's functional currency.

Note: Round your "exchange rates" to decimal places in intermediate calculations. Round your final answers to nearest whole dollar. If no adjustment is needed, select No Entry Necessary'.

Show less

begintabularll

hline multicolumncTranslated December X balance sheet:

hline & Translated Trial Balance in $

hline Cash & $

hline Receivables &

hline Inventory &

hline Fixed assets &

hline Total & $

hline Accumulated other comprehensive income Translation adjustment &

hline Total debits & $

hline Current payables & $

hline Longterm debt &

hline Common stock &

hline Retained earnings &

hline Total &

hline No entry necessary &

hline Total credits & $

hline

endtabular a Present both the direct and the indirect exchange rates for the rupees for the three dates of January X; December X; and December X

b Prepare the subsidiary's translated balance sheet as of December X assuming the rupee is the subsidiary's functional currency.

c Prepare the subsidiary's translated balance sheet as of December times assuming the rupee is the subsidiary's functional currency.

d Compute the amount that Xs other comprehensive income would include as a result of the translation.

Complete this question by entering your answers in the tabs below.

Compute the amount that Xs other comprehensive income would include as a result of the translation.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock