Question: A private not - for - profit organization received a gift of $ 4 6 0 , 0 0 0 with purpose restrictions in 2

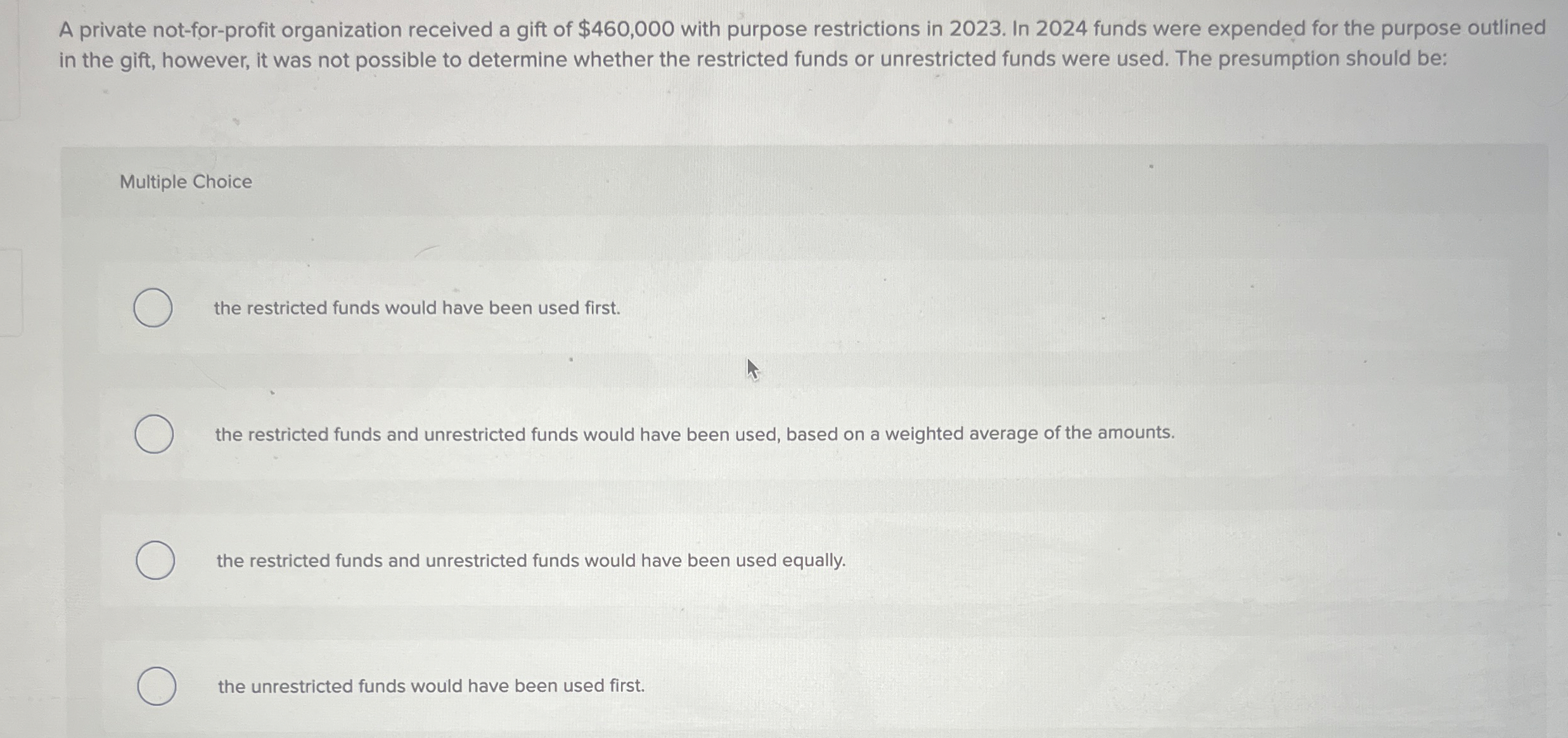

A private notforprofit organization received a gift of $ with purpose restrictions in In funds were expended for the purpose outlined in the gift, however, it was not possible to determine whether the restricted funds or unrestricted funds were used. The presumption should be:

Multiple Choice

the restricted funds would have been used first.

the restricted funds and unrestricted funds would have been used, based on a weighted average of the amounts.

the restricted funds and unrestricted funds would have been used equally.

the unrestricted funds would have been used first.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock