Question: A private not-forprofit entity is working to create a cure for a disease. The charity starts the year with one asset, cash of $700,000. Net

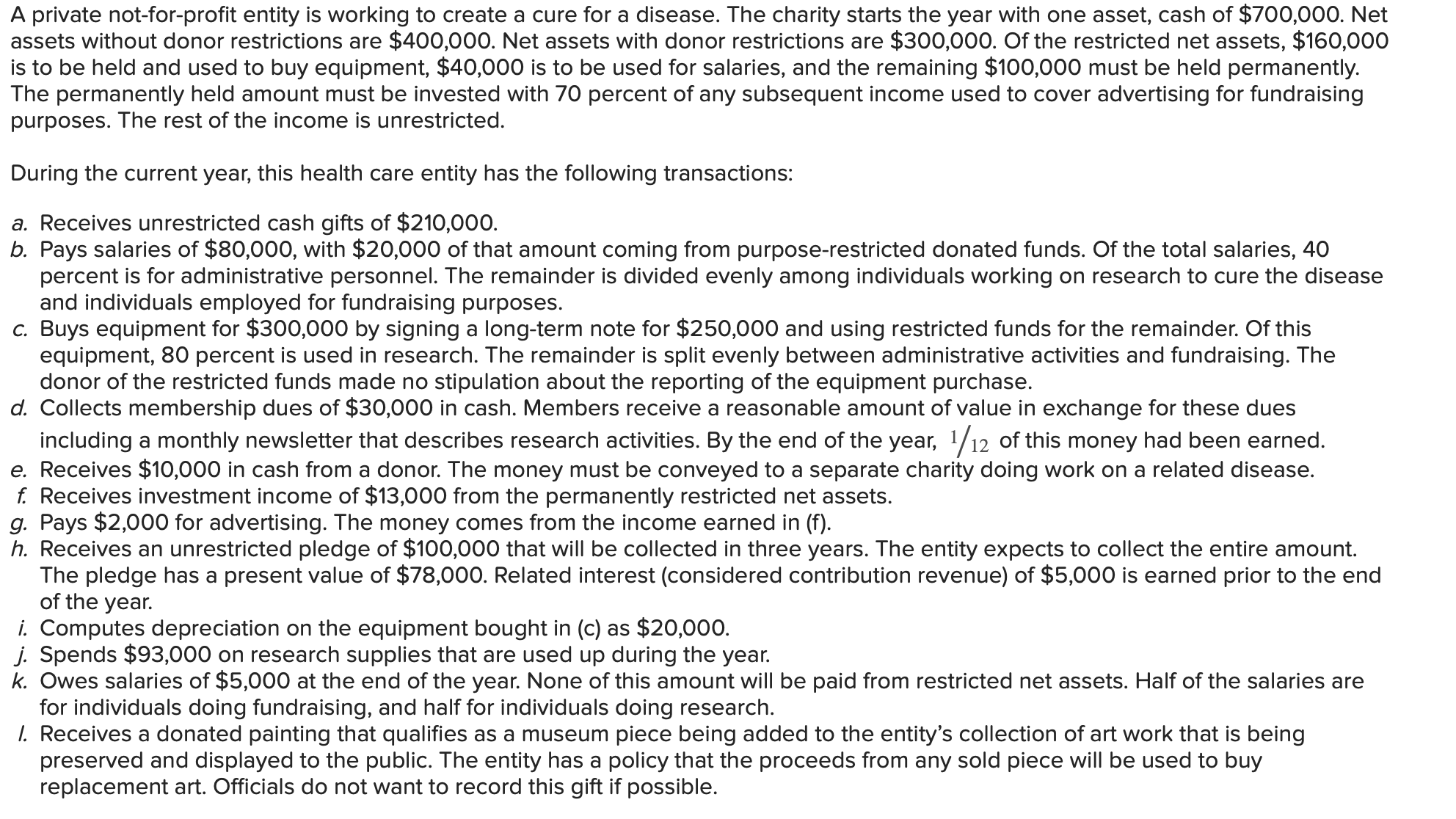

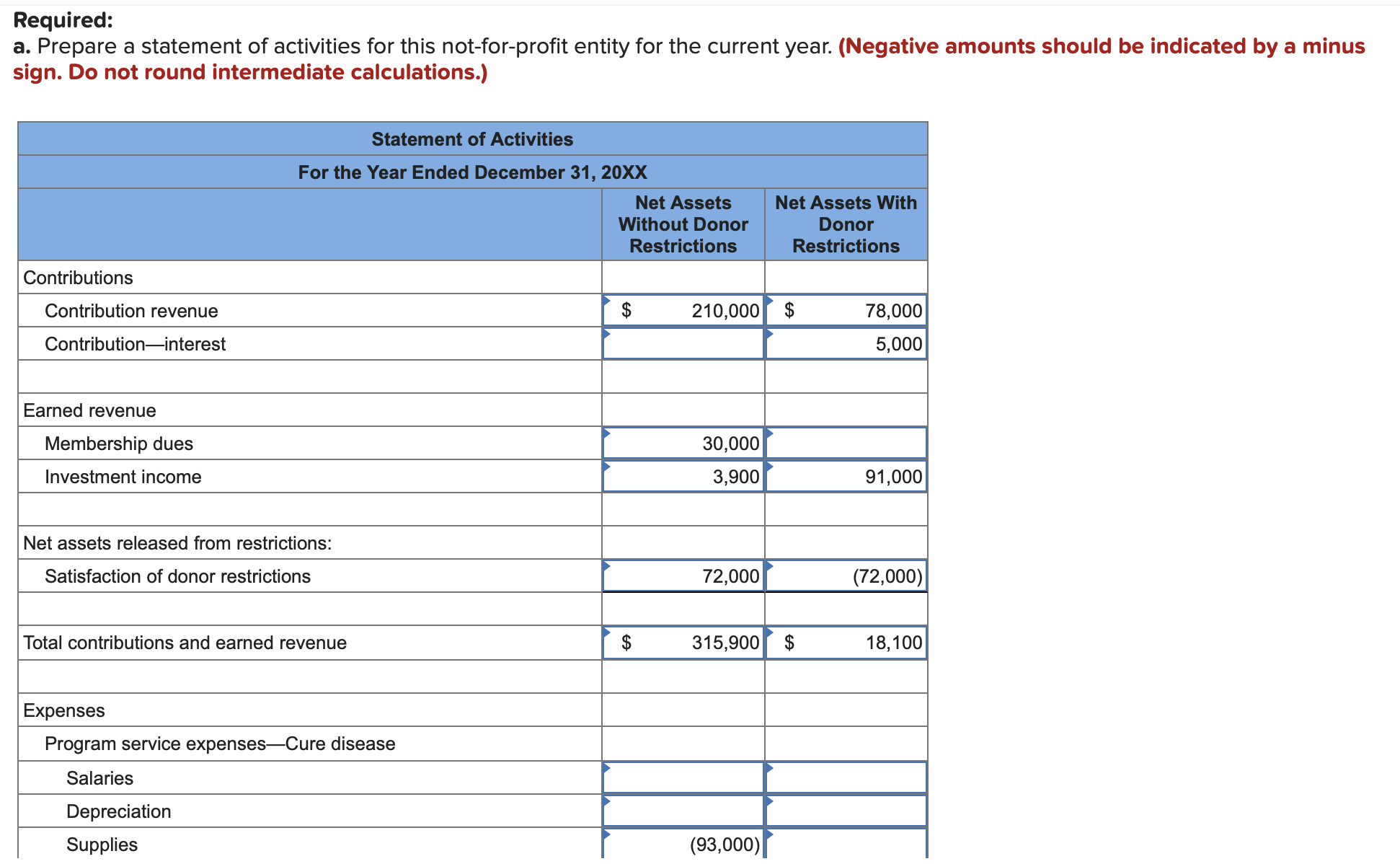

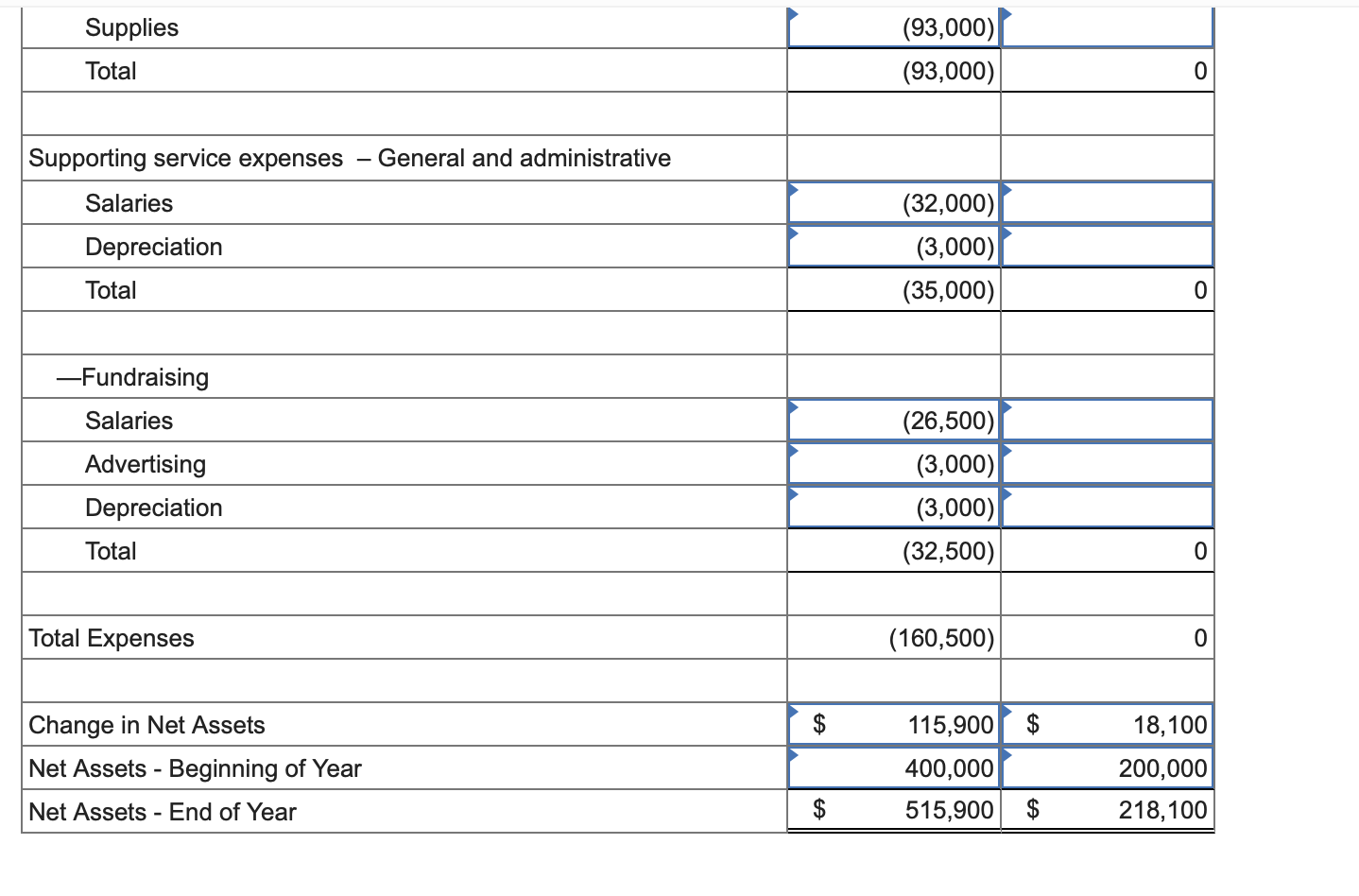

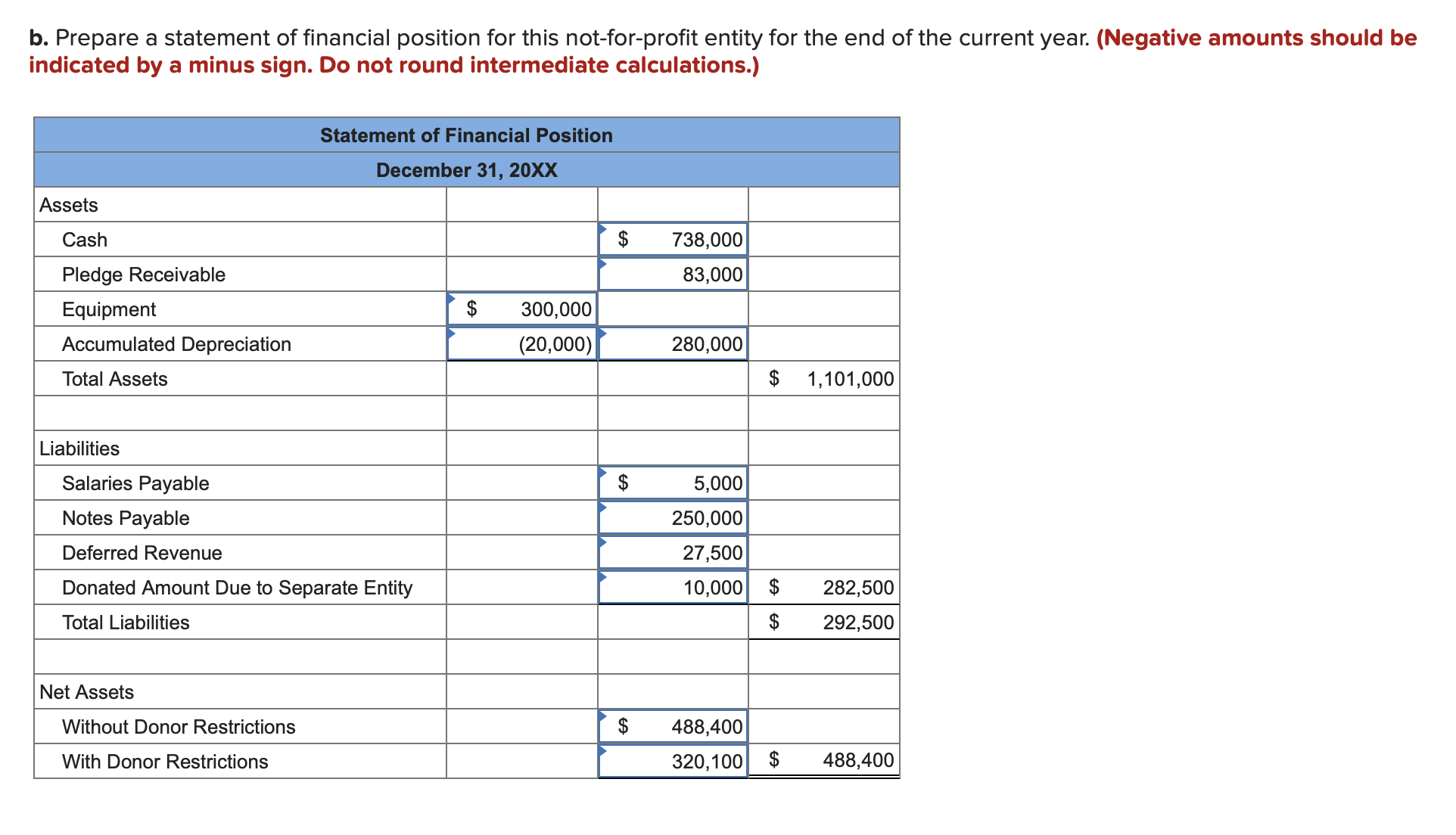

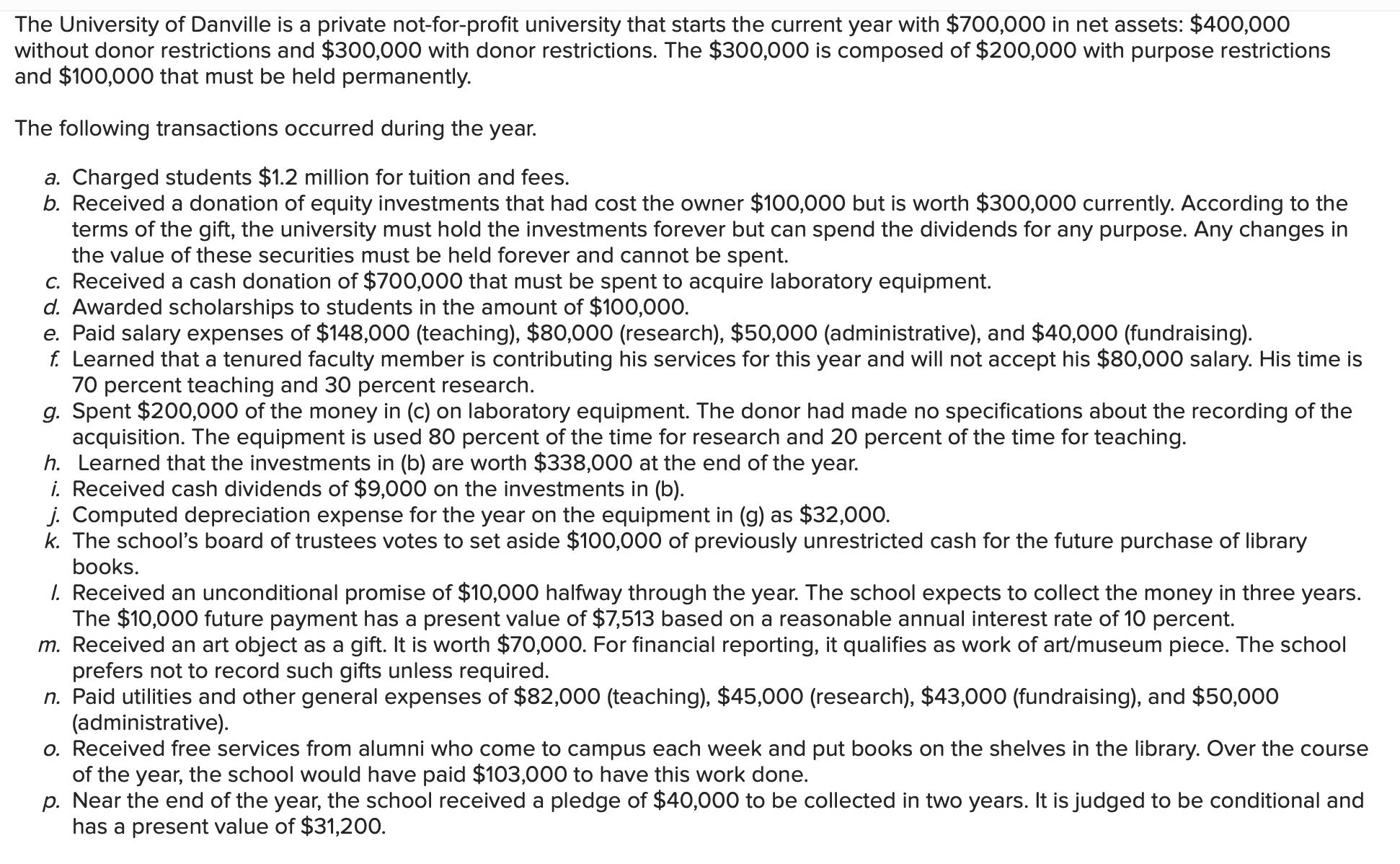

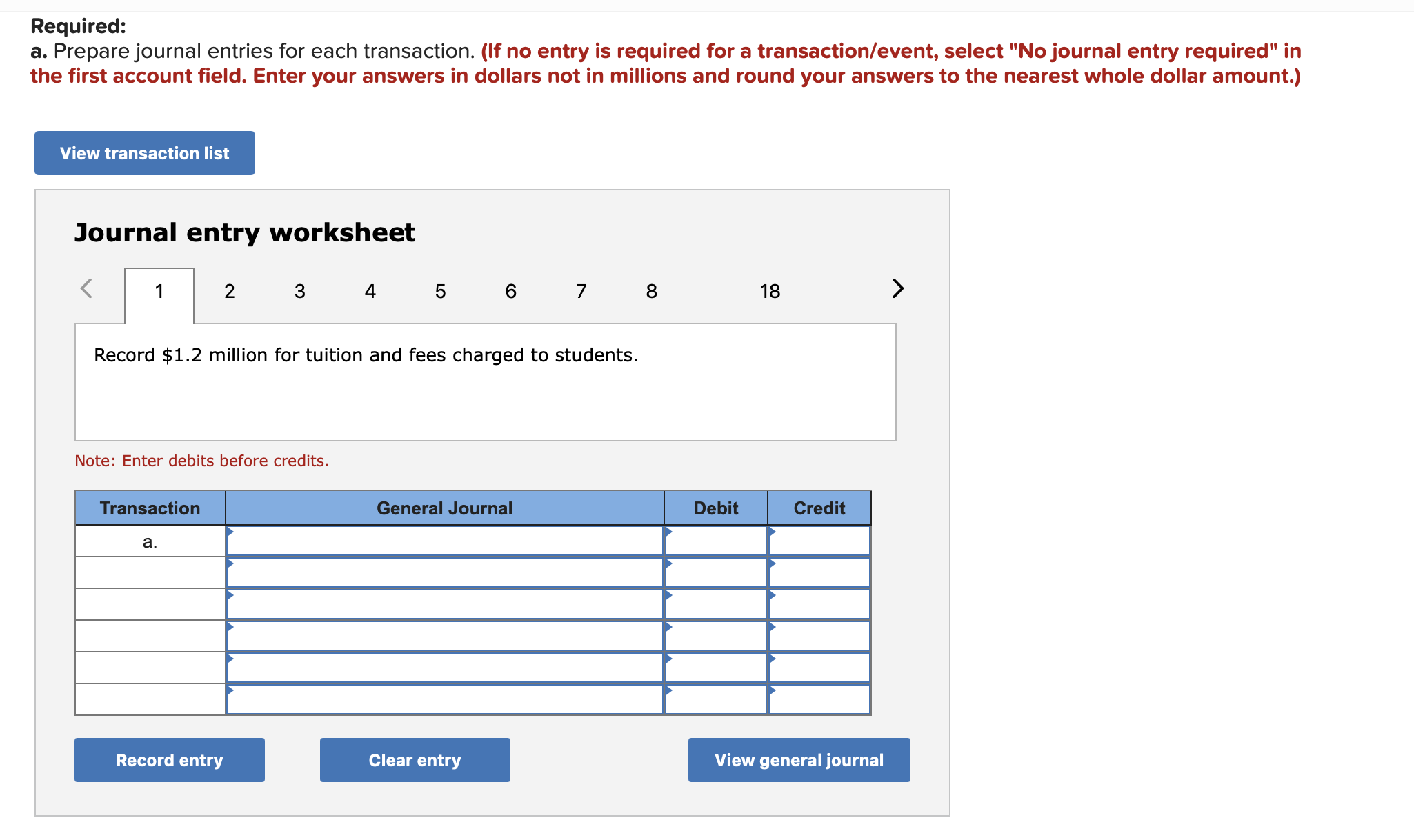

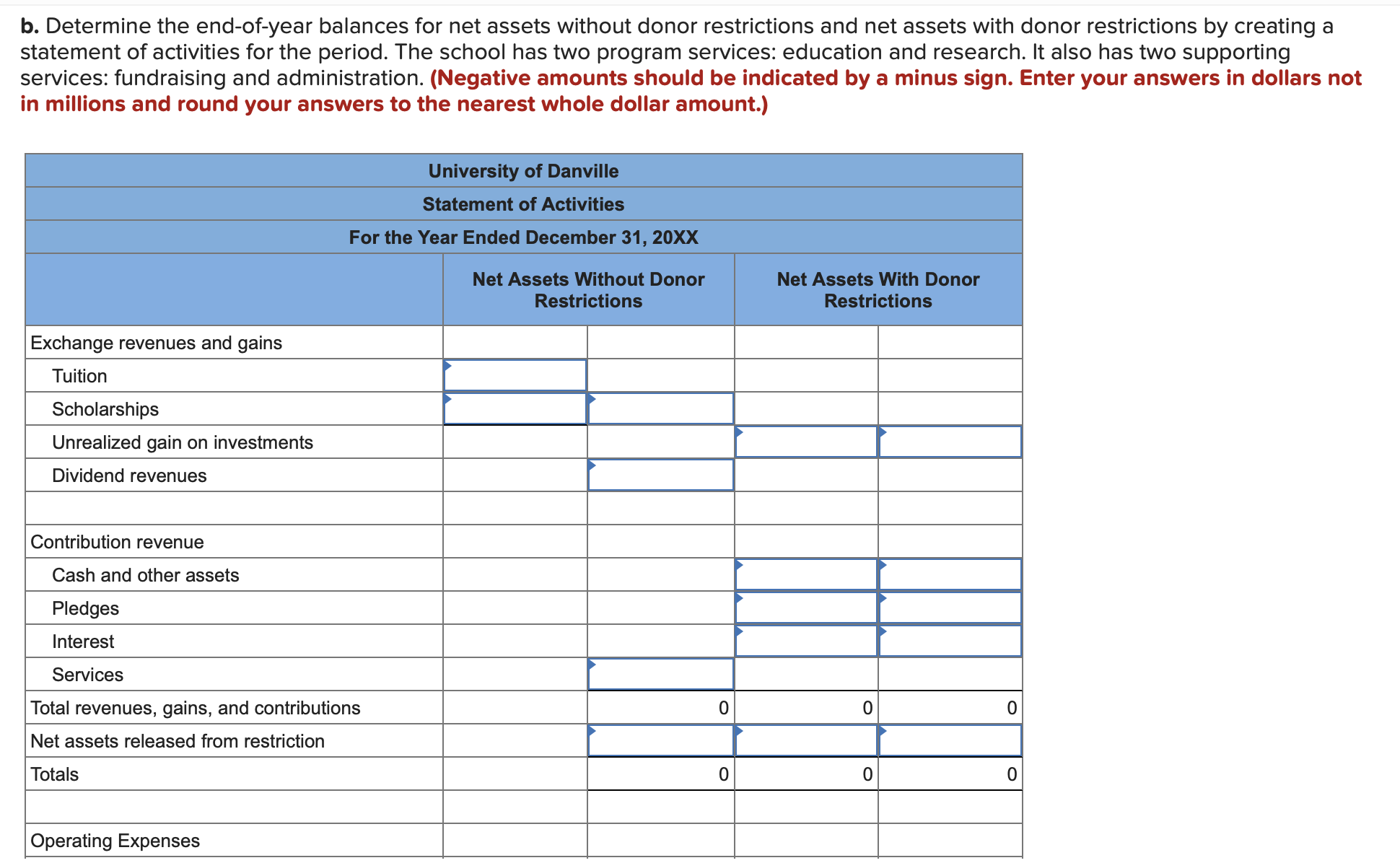

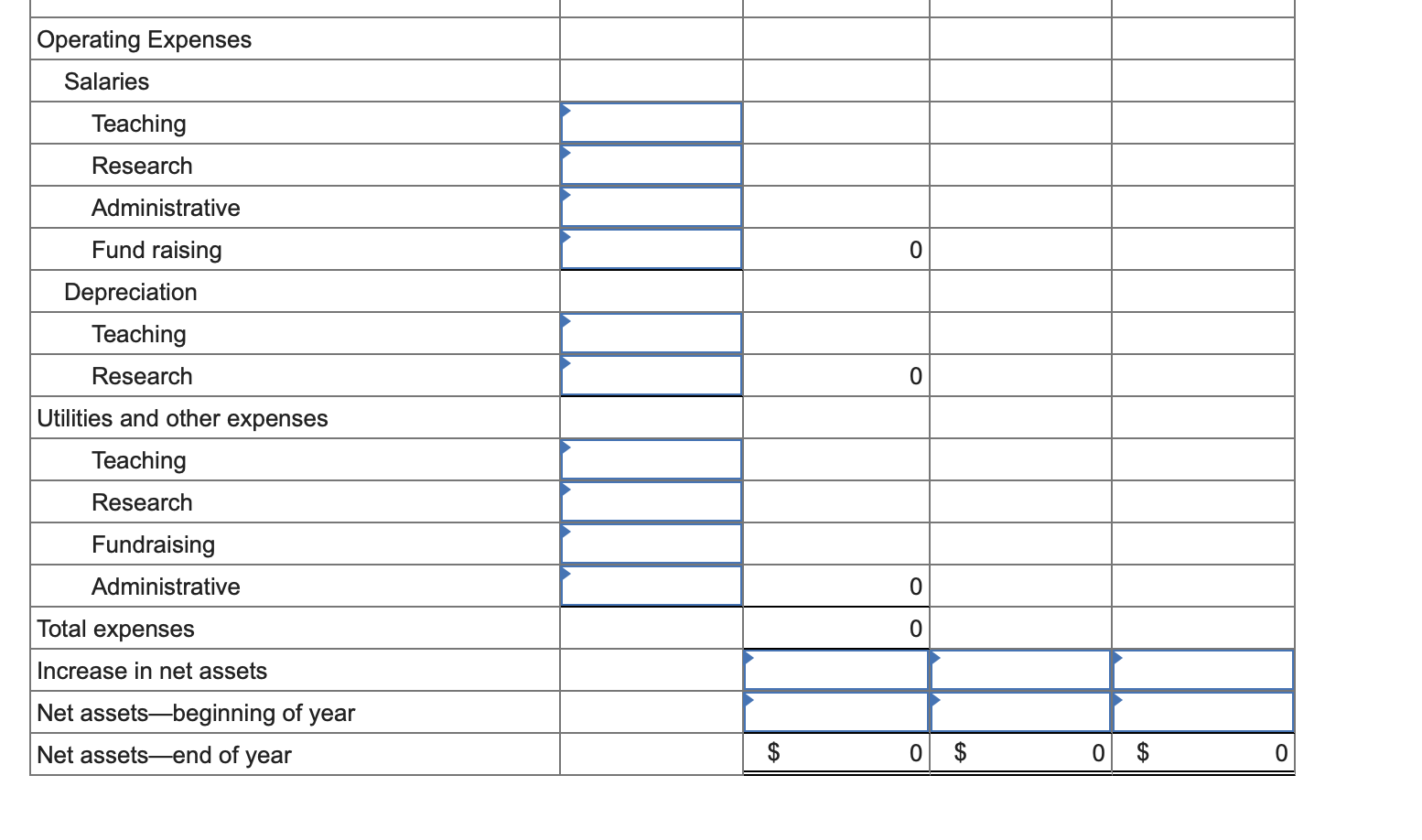

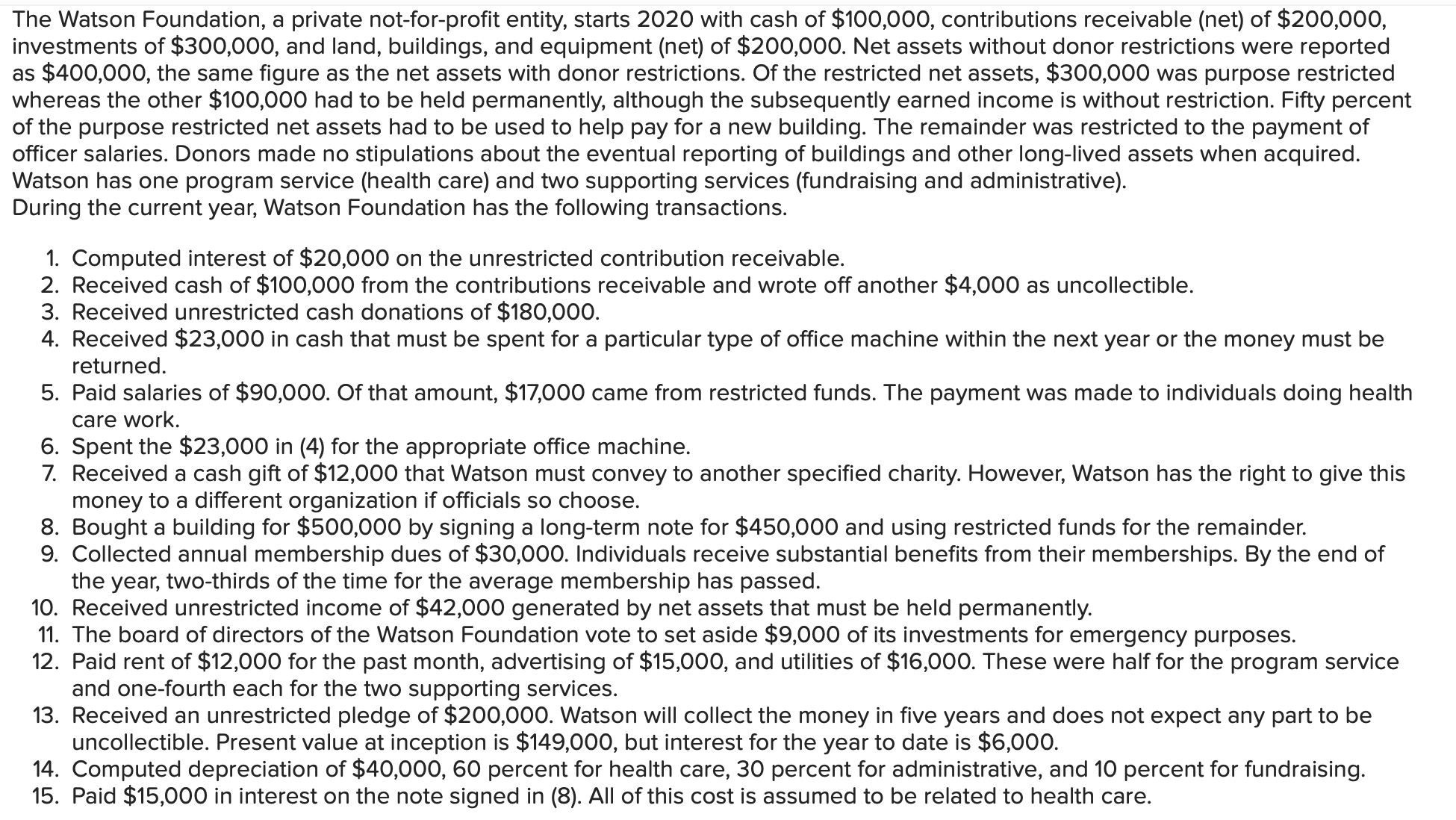

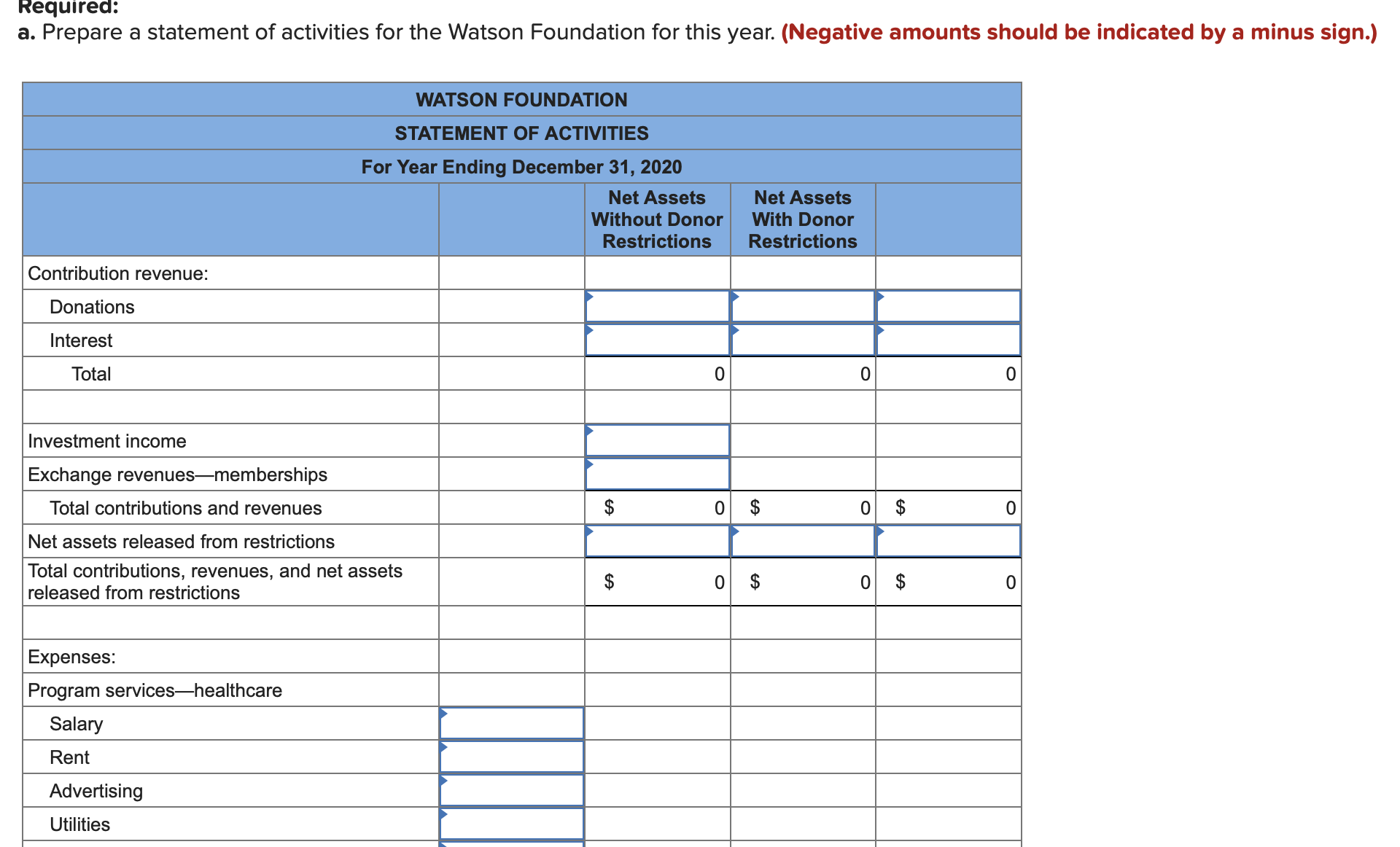

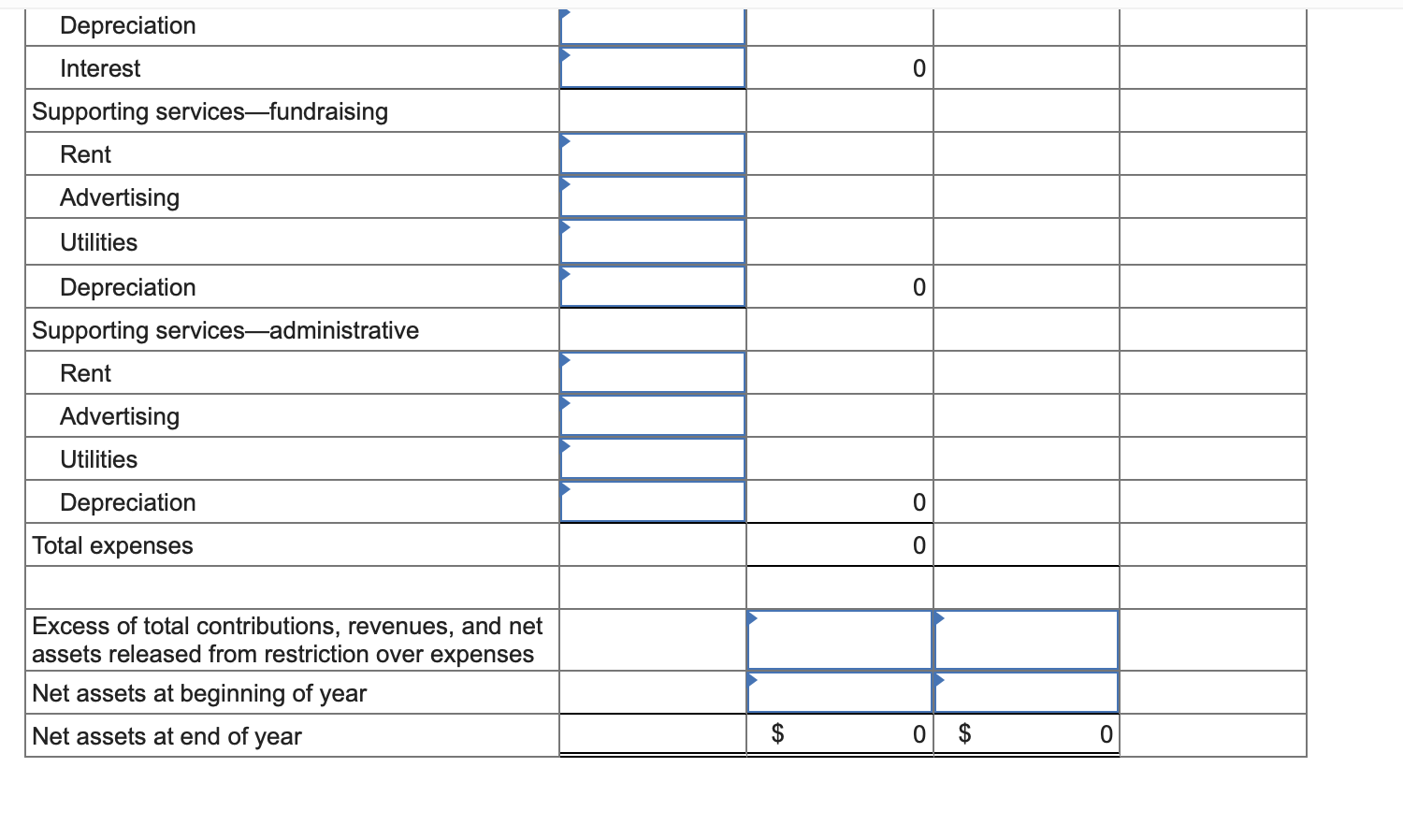

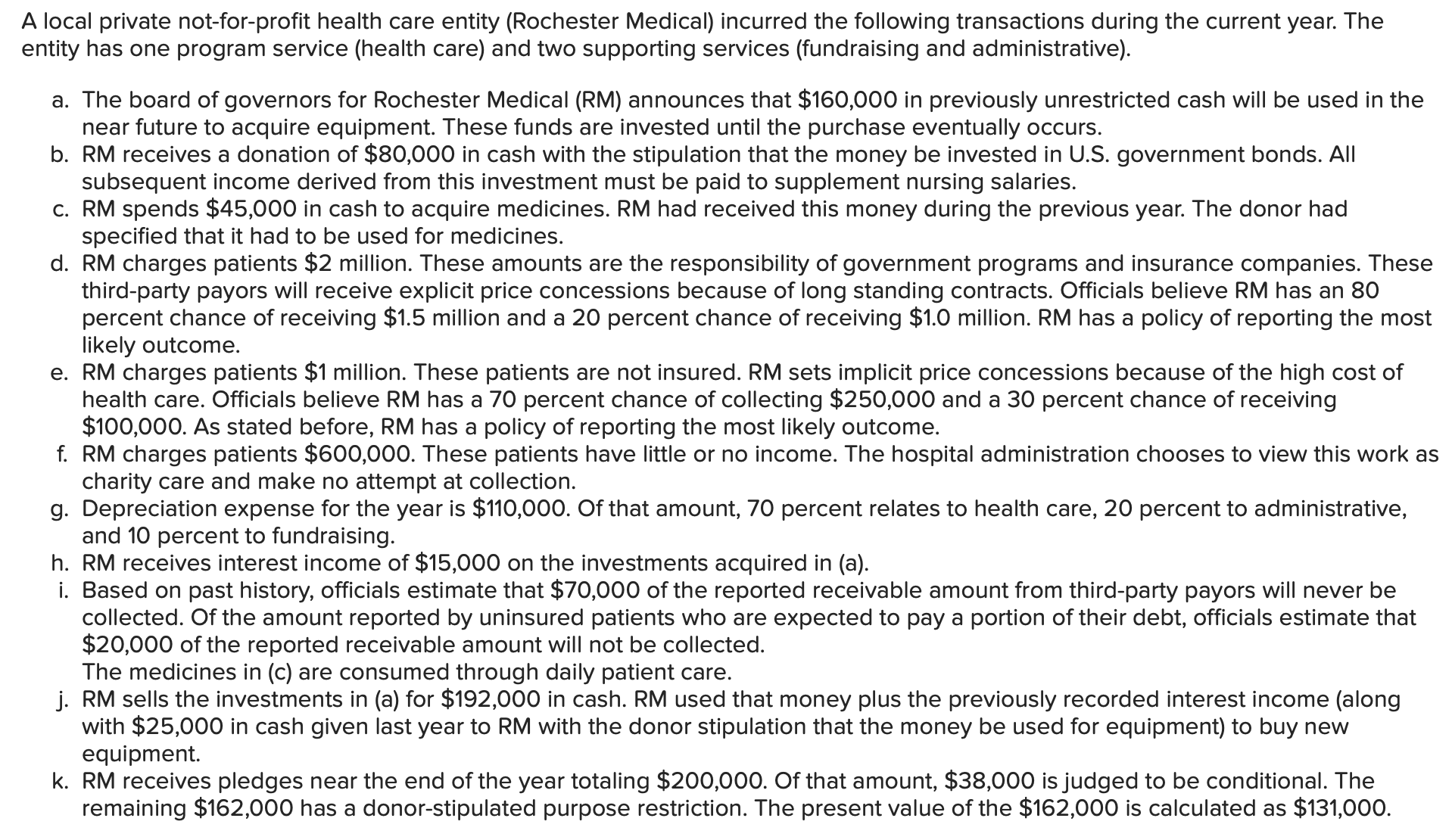

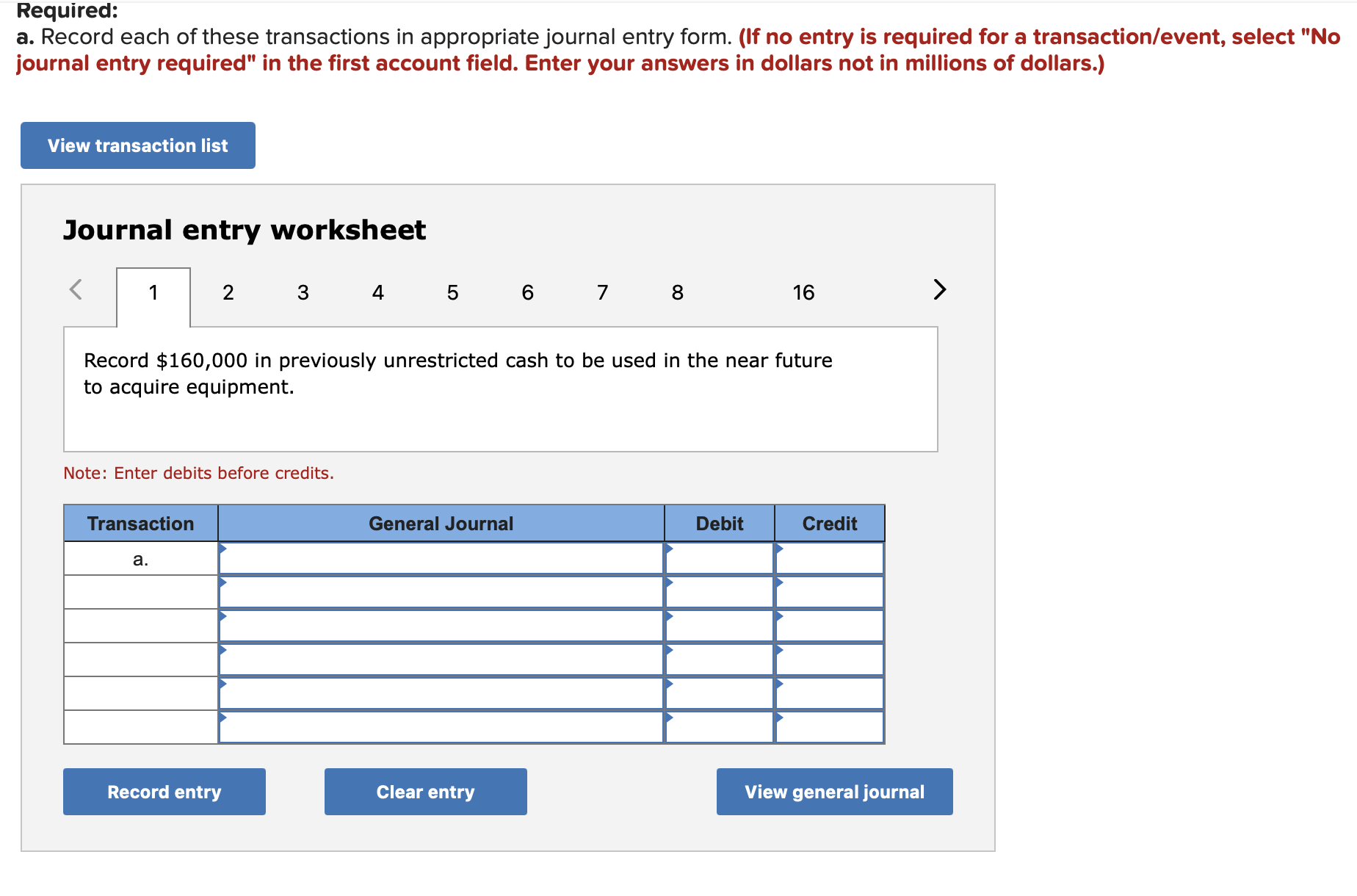

A private not-forprofit entity is working to create a cure for a disease. The charity starts the year with one asset, cash of $700,000. Net assets without donor restrictions are $400,000. Net assets with donor restrictions are $300,000. Of the restricted net assets, $160,000 is to be held and used to buy equipment, $40,000 is to be used for salaries, and the remaining $100,000 must be held permanently. The permanently held amount must be invested with 70 percent of any subsequent income used to cover advertising for fundraising purposes. The rest of the income is unrestricted. During the current year, this health care entity has the following transactions: a b. 9. .3959 rm we. . Receives unrestricted cash gifts of $210,000. Pays salaries of $80,000, with $20,000 of that amount coming from purpose-restricted donated funds. Of the total salaries, 40 percent is for administrative personnel. The remainder is divided evenly among individuals working on research to cure the disease and individuals employed for fundraising purposes. Buys equipment for $300,000 by signing a long-term note for $250,000 and using restricted funds for the remainder. Of this equipment, 80 percent is used in research. The remainder is split evenly between administrative activities and fundraising. The donor of the restricted funds made no stipulation about the reporting of the equipment purchase. Collects membership dues of $30,000 in cash. Members receive a reasonable amount of value in exchange for these dues including a monthly newsletter that describes research activities. By the end of the year, 1/12 of this money had been earned. Receives $10,000 in cash from a donor. The money must be conveyed to a separate charity doing work on a related disease. Receives investment income of $13,000 from the permanently restricted net assets. Pays $2,000 for advertising. The money comes from the income earned in (f). Receives an unrestricted pledge of $100,000 that will be collected in three years. The entity expects to collect the entire amount. The pledge has a present value of $78,000. Related interest (considered contribution revenue) of $5,000 is earned prior to the end of the year. Computes depreciation on the equipment bought in (c) as $20,000. Spends $93,000 on research supplies that are used up during the year. Owes salaries of $5,000 at the end of the year. None of this amount will be paid from restricted net assets. Half of the salaries are for individuals doing fundraising, and half for individuals doing research. Receives a donated painting that qualifies as a museum piece being added to the entity's collection of art work that is being preserved and displayed to the public. The entity has a policy that the proceeds from any sold piece will be used to buy replacement art. Ofcials do not want to record this gift if possible. Required: a. Prepare a statement of activities for this notforprofit entity for the current year. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) Contributions Contribution revenue $ 210.000 Contributioninterest Earned revenue Membership dues 30.000 Investment income 3,90 Net assets released from restrictions: Satisfaction of donor restrictions 72,000 Total contributions and earned revenue $ 315.900 $ 78,000 91,000 (72,000) $ 18,100 Expenses Program service expensesCure disease Salaries Depreciation Supplies (93,000) Supplies Total (93,000) (93,000) Supporting service expenses General and administrative Depreciation Total Fundraising Advertising Depreciation (3,000) Total (32,500 v Total Expenses (160,500) $ 115,90 $ 18,100 200,000 $ 218,100 Change in Net Assets Net Assets - Beginning of Year 400,00 Net Assets - End of Year $ 515,900 0 b. Prepare a statement of nancial position for this not-forprot entity for the end of the current year. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations.) Assets _= Cash 38, 000 Pledge Receivable 83,000 Equipment $ 300,000 _ Accumulated Depreciation (20,000) 280,000 Total Assets $ 1,101,000 Liabilities = Salaries Payable 5 000 Notes Payable 250, 000 Deferred Revenue _ 27, 500 Donated Amount Due to Separate Entity $ 282,500 Total Liabilities _0 $ 292,500 Without Donor Restrictions 88. 400 With Donor Restrictions 320,100 $ 488,400 The University of Danville is a private not-for-profit university that starts the current year with $700,000 in net assets: $400,000 without donor restrictions and $300,000 with donor restrictions. The $300,000 is composed of $200,000 with purpose restrictions and $100,000 that must be held permanently. The following transactions occurred during the year. 9'9) H19 9-0 ,\\ Charged students $1.2 million for tuition and fees. Received a donation of equity investments that had cost the owner $100,000 but is worth $300,000 currently. According to the terms of the gift, the university must hold the investments forever but can spend the dividends for any purpose. Any changes in the value of these securities must be held forever and cannot be spent. Received a cash donation of $700,000 that must be spent to acquire laboratory equipment. Awarded scholarships to students in the amount of $100,000. Paid salary expenses of $148,000 (teaching), $80,000 (research), $50,000 (administrative), and $40,000 (fundraising). Learned that a tenured faculty member is contributing his services for this year and will not accept his $80,000 salary. His time is 70 percent teaching and 30 percent research. Spent $200,000 of the money in (c) on laboratory equipment. The donor had made no specifications about the recording of the acquisition. The equipment is used 80 percent of the time for research and 20 percent of the time for teaching. Learned that the investments in (b) are worth $338,000 at the end of the year. Received cash dividends of $9,000 on the investments in (b). Computed depreciation expense for the year on the equipment in (g) as $32,000. The school's board of trustees votes to set aside $100,000 of previously unrestricted cash for the future purchase of library books. Received an unconditional promise of $10,000 halfway through the year. The school expects to collect the money in three years. The $10,000 future payment has a present value of $7,513 based on a reasonable annual interest rate of 10 percent. Received an art object as a gift. It is worth $70,000. For financial reporting, it qualifies as work of art/museum piece. The school prefers not to record such gifts unless required. Paid utilities and other general expenses of $82,000 (teaching), $45,000 (research), $43,000 (fundraising). and $50,000 (administrative). Received free services from alumni who come to campus each week and put books on the shelves in the library. Over the course of the year, the school would have paid $103,000 to have this work done. Near the end of the year, the school received a pledge of $40,000 to be collected in two years. It isjudged to be conditional and has a present value of $31,200. Required: a. Prepare journal entries for each transaction. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars not in millions and round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet Record $1.2 million for tuition and fees charged to students. Note: Enter debits before credits. Record entry Clear entry View general journal b. Determine the end-ofyear balances for net assets without donor restrictions and net assets with donor restrictions by creating a statement of activities for the period. The school has two program services: education and research. It also has two supporting services: fundraising and administration. (Negative amounts should be indicated by a minus sign. Enter your answers in dollars not in millions and round your answers to the nearest whole dollar amount.) Exchange revenues and gains Tuition Scholarships Unrealized gain on investments Dividend revenues Contribution revenue Cash and other assets Pledges Interest Services Total revenues, gains, and contributions Net assets released from restriction Operating Expenses Operating Expenses Salaries Teaching Research Administrative Fund raising 0 Depreciation Teaching Research 0 Utilities and other expenses Teaching Research Fundraising Administrative O Total expenses O Increase in net assets Net assets-beginning of year EA Net assets-end of year 0 $ 0 $ 0The Watson Foundation, a private not-for-prot entity, starts 2020 with cash of $100,000, contributions receivable (net) of $200,000, investments of $300,000, and land, buildings, and equipment (net) of $200,000. Net assets without donor restrictions were reported as $400,000, the same gure as the net assets with donor restrictions. Of the restricted net assets, $300,000 was purpose restricted whereas the other $100,000 had to be held permanently, although the subsequently earned income is without restriction. Fifty percent of the purpose restricted net assets had to be used to help pay for a new building. The remainder was restricted to the payment of officer salaries. Donors made no stipulations about the eventual reporting of buildings and other longlived assets when acquired. Watson has one program service (health care) and two supporting services (fundraising and administrative). During the current year, Watson Foundation has the following transactions. PWN.' .0" 51.01 10. 11. 12. 13. 14. 15. Computed interest of $20,000 on the unrestricted contribution receivable. Received cash of $100,000 from the contributions receivable and wrote off another $4,000 as uncollectible. Received unrestricted cash donations of $180,000. Received $23,000 in cash that must be spent for a particular type of office machine within the next year or the money must be returned. Paid salaries of $90,000. Of that amount, $17,000 came from restricted funds. The payment was made to individuals doing health care work. Spent the $23,000 in (4) for the appropriate office machine. Received a cash gift of $12,000 that Watson must convey to another specified charity. However, Watson has the right to give this money to a different organization if ofcials so choose. Bought a building for $500,000 by signing a long-term note for $450,000 and using restricted funds for the remainder. Collected annual membership dues of $30,000. Individuals receive substantial benefits from their memberships. By the end of the year, twothirds of the time for the average membership has passed. Received unrestricted income of $42,000 generated by net assets that must be held permanently. The board of directors of the Watson Foundation vote to set aside $9,000 of its investments for emergency purposes. Paid rent of $12,000 for the past month, advertising of $15,000, and utilities of $16,000. These were half for the program service and one-fourth each for the two supporting services. Received an unrestricted pledge of $200,000. Watson will collect the money in ve years and does not expect any part to be uncollectible. Present value at inception is $149,000, but interest for the year to date is $6,000. Computed depreciation of $40,000, 60 percent for health care, 30 percent for administrative, and 10 percent for fundraising. Paid $15,000 in interest on the note signed in (8). All ofthis cost is assumed to be related to health care. Required: a. Prepare a statement of activities for the Watson Foundation for this year. (Negative amounts should be indicated by a minus sign.) Contribution revenue: __ Donations __ Interest =-()- 0 $ 0 $ 0 Total Investment income -= Exchange revenuesmemberships Total contributions and revenues = $ 0 Net assets released from restrictions Total contributions. revenues. and net assets $ 0 released from restrictions Expenses: Program serviceshealthcare Salary _ Rent _ Advertising Depreciation Supporting servicesfundraising Advertising Utilities Depreciation Supporting servicesadministrative Advertising Utilities Depreciation Total expenses Excess of total contributions, revenues, and net assets released from restriction over expenses Net assets at beginning of year Net assets at end of year b. Prepare a statement of nancial position for the Watson Foundation at the end of this year. (Negative amounts should be indicated by a minus sign.) Contributions receivable (net) Investments Investmentsinternally restricted Land, buildings, and equipment (net) Total assets $ 0 Liabilities Deferred revenues Notes payable Total liabilities $ 0 Net Assets Without donor restrictions: Unrestricted Board-designated for emergency purposes 0 With donor restrictions Total net assets 0 A local private not-forprot health care entity (Rochester Medical) incurred the following transactions during the current year. The entity has one program service (health care) and two supporting services (fundraising and administrative). a. The board of governors for Rochester Medical (RM) announces that $160,000 in previously unrestricted cash will be used in the near future to acquire equipment. These funds are invested until the purchase eventually occurs. b. RM receives a donation of $80,000 in cash with the stipulation that the money be invested in US. government bonds. All subsequent income derived from this investment must be paid to supplement nursing salaries. c. RM spends $45,000 in cash to acquire medicines. RM had received this money during the previous year. The donor had specified that it had to be used for medicines. d. RM charges patients $2 million. These amounts are the responsibility of government programs and insurance companies. These thirdparty payors will receive explicit price concessions because of long standing contracts. Ofcials believe RM has an 80 percent chance of receiving $1.5 million and a 20 percent chance of receiving $1.0 million. RM has a policy of reporting the most likely outcome. e. RM charges patients $1 million. These patients are not insured. RM sets implicit price concessions because of the high cost of health care. Officials believe RM has a 70 percent chance of collecting $250,000 and a 30 percent chance of receiving $100,000. As stated before, RM has a policy of reporting the most likely outcome. f. RM charges patients $600,000. These patients have little or no income. The hospital administration chooses to view this work as charity care and make no attempt at collection. 9. Depreciation expense for the year is $110,000. Of that amount, 70 percent relates to health care, 20 percent to administrative, and 10 percent to fundraising. h. RM receives interest income of $15,000 on the investments acquired in (a). i. Based on past history, officials estimate that $70,000 of the reported receivable amount from third-party payors will never be collected. Of the amount reported by uninsured patients who are expected to pay a portion of their debt, ofcials estimate that $20,000 of the reported receivable amount will not be collected. The medicines in (c) are consumed through daily patient care. j. RM sells the investments in (a) for $192,000 in cash. RM used that money plus the previously recorded interest income (along with $25,000 in cash given last year to RM with the donor stipulation that the money be used for equipment) to buy new equipment. k. RM receives pledges near the end of the year totaling $200,000. Of that amount, $38,000 isjudged to be conditional. The remaining $162,000 has a donor-stipulated purpose restriction. The present value of the $162,000 is calculated as $131,000. Required: a. Record each of these transactions in appropriate journal entry form. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in dollars not in millions of dollars.) View transaction list Journal entry worksheet Record $160,000 in previously unrestricted cash to be used in the near future to acquire equipment. Note: Enter debits before credits. Record entry Clear entry View general journal b. Prepare a schedule calculating the change in net assets without donor restrictions and net assets with donor restrictions. (Negative amounts should be indicated by a minus sign. Enter your answers in dollars not in millions of dollars.) Contribution revenue Patient service revenues Interest income Gain on sale of investments Reclassied from net assets with donor restrictions to net assets without donor restrictions Contributions, revenues. and reclassications Expenses Healthcare Depreciation Bad debts Pharmaceutical Administrative Depreciation Fundraising 9 OD Depreciation Total expenses 9) 0 Increase in net assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts