Question: a. Pro A b. Pro B c, Pro C d. All three e. None. 14. If you pay $1,000 for a 30-year bond that pays

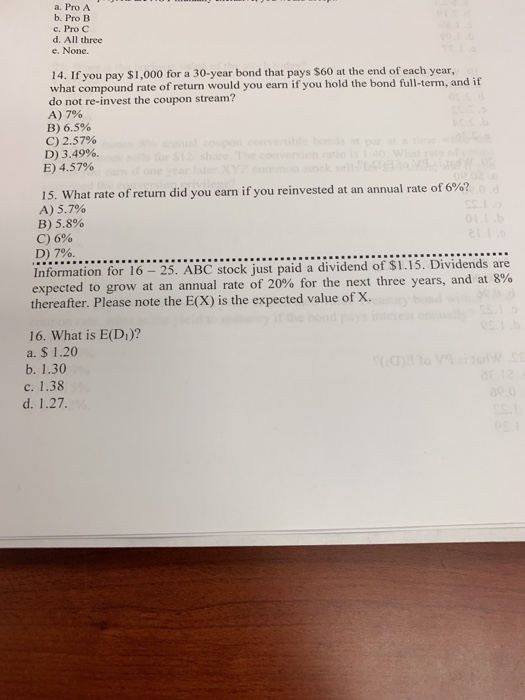

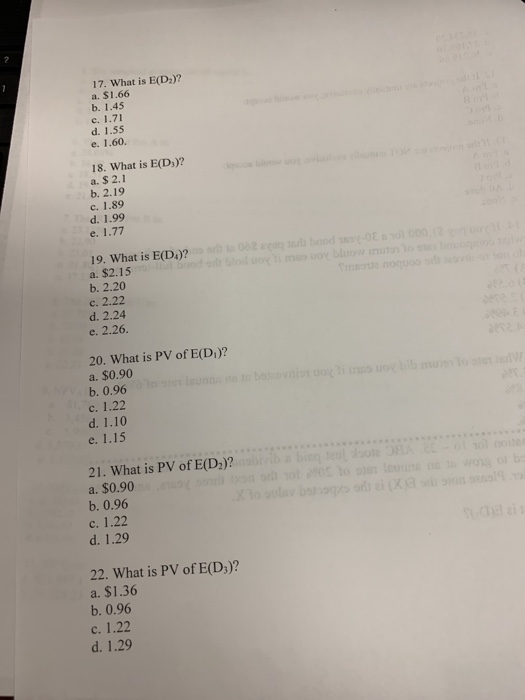

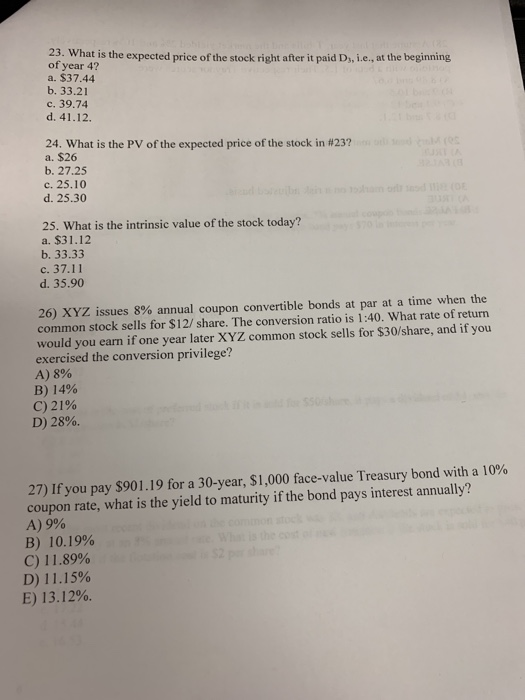

a. Pro A b. Pro B c, Pro C d. All three e. None. 14. If you pay $1,000 for a 30-year bond that pays $60 at the end of each year, what compound rate of return would you earn if you hold the bond full-term, and if do not re-invest the coupon stream? A)7% B) 6.5% C) 2.57% D) 3.49%. E) 4.57% 15. What rate of return did you earn if you reinvested at an annual rate of 6%? A) 5.7% B) 5.8% C) 6% D) 796. Information for 16 - 25. ABC stock just paid a dividend of $1.15. Dividends are expected to grow at an annual rate of 20% for the next three years, and at 800 thereafter. Please note the E(X) is the expected value of X. 16. What is E(Di)? a. $ 1.20 b. 1.30 c. 1.38 d. 1.27. 17. What is E(D:)? a. $1.66 b. 1.45 c. 1.7 d. 1.55 e. 1.60. 18. What is E(D,)? a. $ 2.1 b. 2.19 c. 1.89 d. 1.99 19. What is E(D)? a. $2.15 b. 2.20 c. 2.22 d. 2.24 e. 2.26. 20. What is PV of E(D,)? a. $0.90 b. 0.96 c. 1.22 d. 1.10 e. 1.15 21. What is PV of E(D2)? a. $0.90 b. 0.96 c. 1.22 d. 1.29 22. What is PV of E(D;)? a. $1.36 b. 0.96 c. 1.22 d. 1.29 23. What is the expected price of the stock right after it paid Ds, i.e., at the beginning of year 4 a. $37.44 b. 33.21 c. 39.74 d. 41.12. 24, what is the PV of the expected price of the stock in #23? a. $26 b. 27.25 c. 25.10 d. 25.30 25. What is the intrinsic value of the stock today? a. $31.12 b. 33.33 . 37.11 d. 35.90 26) XYZ issues 8% annual coupon convertible bonds at par at a time when the common stock sells for $12/ share. The conversion ratio is 1:40. What rate of return would you earn if one year later XYZ common stock sells for $30/share, and if you exercised the conversion privilege? A) 8% B) 14% C)21% D) 28%. 27) Ifyou pay $901.19 for a 30-year, $1,000 face-value Treasury bond with a 10% coupon rate, what is the yield to maturity if the bond pays interest annually? A)9% B) 10.19% C) 11.89% D) 1 1 . 1 5% E) 13.12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts