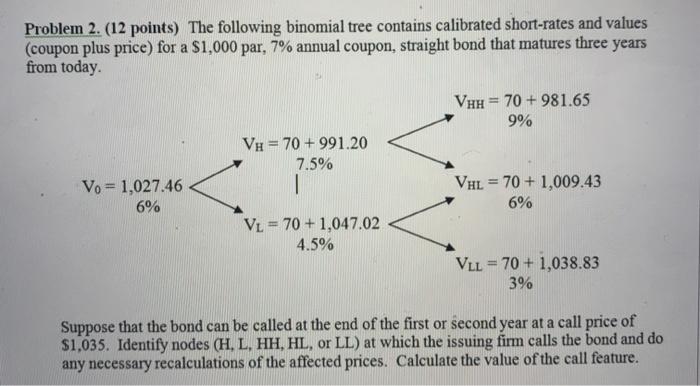

Question: a Problem 2. (12 points) The following binomial tree contains calibrated short-rates and values (coupon plus price) for a $1,000 par, 7% annual coupon, straight

a Problem 2. (12 points) The following binomial tree contains calibrated short-rates and values (coupon plus price) for a $1,000 par, 7% annual coupon, straight bond that matures three years from today. Vhh = 70 +981.65 9% Vu = 70+ 991.20 7.5% Vo = 1,027.46 VhL = 70+ 1,009.43 6% 6% VL = 70 + 1,047.02 4.5% VlL = 70 + 1,038.83 3% Suppose that the bond can be called at the end of the first or second year at a call price of $1,035. Identify nodes (H, L, HH, HL, or LL) at which the issuing firm calls the bond and do any necessary recalculations of the affected prices. Calculate the value of the call feature

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts