Question: A process of selecting, evaluating, and interpreting financial data, along with other pertinent information, in order to formulate an assessment of a company's present and

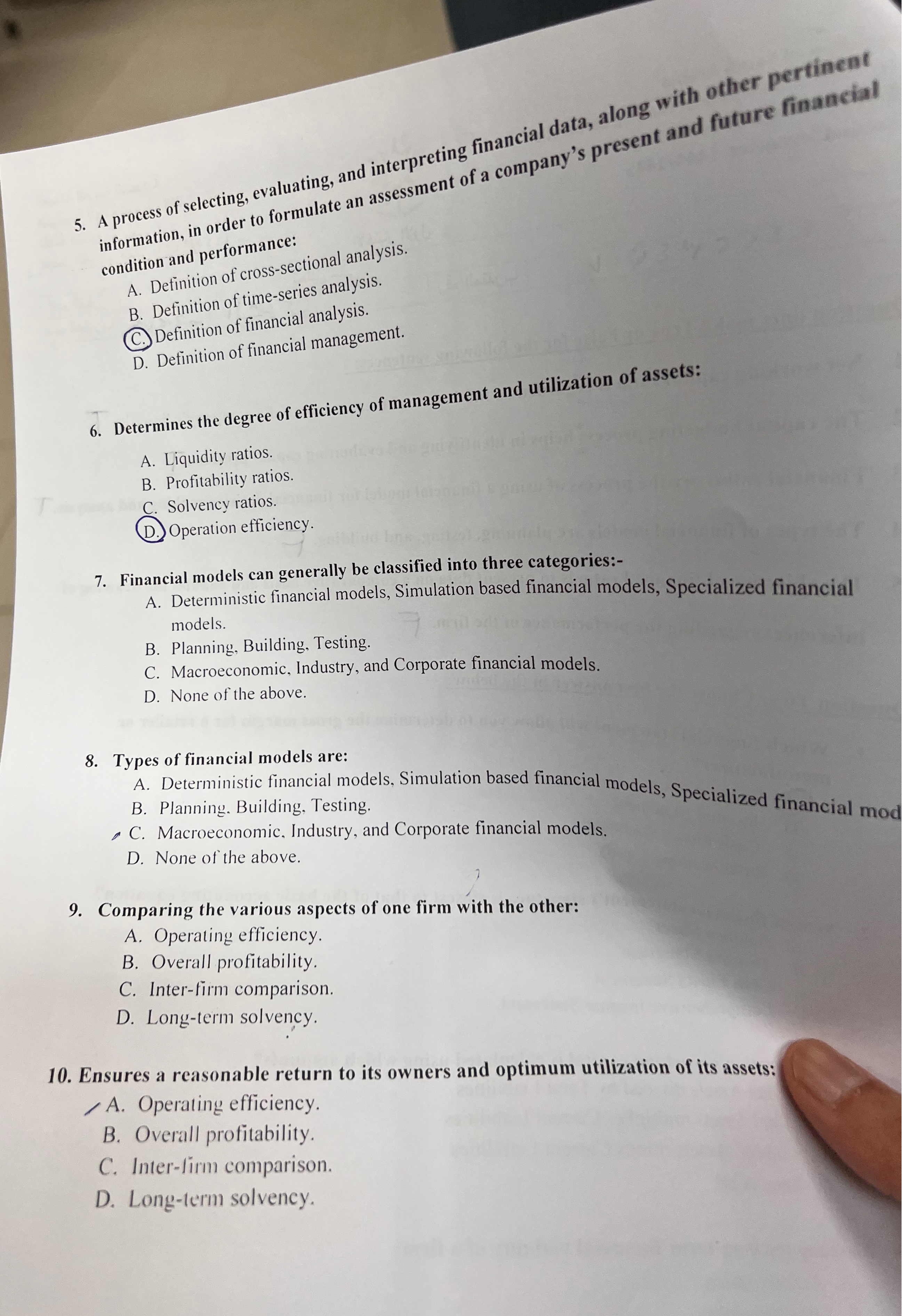

A process of selecting, evaluating, and interpreting financial data, along with other pertinent information, in order to formulate an assessment of a company's present and future financial condition and performance:

A Definition of crosssectional analysis.

B Definition of timeseries analysis.

C Definition of financial analysis.

D Definition of financial management.

Determines the degree of efficiency of management and utilization of assets:

A Liquidity ratios.

B Profitability ratios.

C Solvency ratios.

D Operation efficiency.

Financial models can generally be classified into three categories:

A Deterministic financial models, Simulation based financial models, Specialized financial models.

B Planning, Building, Testing.

C Macroeconomic, Industry, and Corporate financial models.

D None of the above.

Types of financial models are:

A Deterministic financial models, Simulation based financial models, Specialized financial mod

B Planning. Building, Testing.

C Macroeconomic. Industry, and Corporate financial models.

D None of the above.

Comparing the various aspects of one firm with the other:

A Operating efficiency.

B Overall profitability.

C Interfirm comparison.

D Longterm solvency.

Ensures a reasonable return to its owners and optimum utilization of its assets:

A Operating efficiency.

B Overall profitability.

C Interlirm comparison.

D Longterm solvency.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock