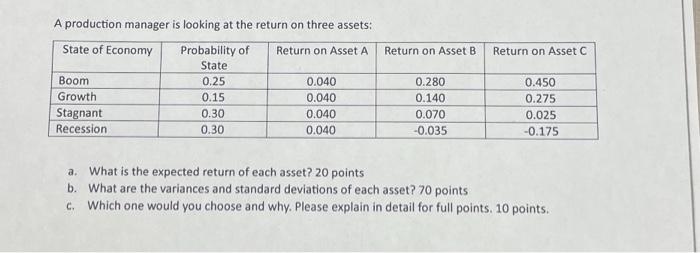

Question: A production manager is looking at the return on three assets: State of Economy Boom Growth Stagnant Recession Probability of Return on Asset A

A production manager is looking at the return on three assets: State of Economy Boom Growth Stagnant Recession Probability of Return on Asset A Return on Asset B Return on Asset C State 0.25 0.040 0.280 0.450 0.15 0.040 0.140 0.275 0.30 0.040 0.070 0.025 0.30 0.040 -0.035 -0.175 a. What is the expected return of each asset? 20 points b. What are the variances and standard deviations of each asset? 70 points c. Which one would you choose and why. Please explain in detail for full points. 10 points.

Step by Step Solution

There are 3 Steps involved in it

Sure I can answer the questions based on the information in the image a Expected Return of Each Asset Asset Expected Return A 0125 B 01075 C 00775 drivespreadsheetEkspor ke Spreadsheet To calculate th... View full answer

Get step-by-step solutions from verified subject matter experts