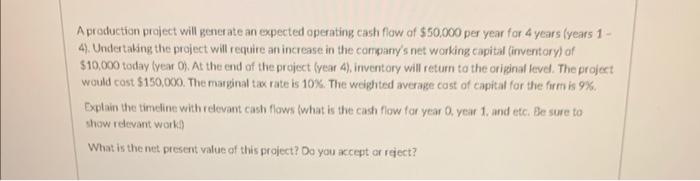

Question: A production project will generate an expected operating cash flow of $50.000 per year for 4 years (years 1 4). Undertaking the project will require

A production project will generate an expected operating cash flow of $50.000 per year for 4 years (years 1 4). Undertaking the project will require an increase in the compary's net working capital (inventory) of $10,000 today (year 0 . At the end of the project (year 4 ), inventory will return to the oripinal level. The project would cost $150,000. The marginal tax rate is 10%. The wdighted average cost of capital for the frrm is 9%. Explain the timdine with recevant cash flows (what is the cash flow for year 0 year 1 . and etc. Be sure to show redevant workd What is the net present value of this project? Do you accept or reject? A production project will generate an expected operating cash flow of $50.000 per year for 4 years (years 1 4). Undertaking the project will require an increase in the compary's net working capital (inventory) of $10,000 today (year 0 . At the end of the project (year 4 ), inventory will return to the oripinal level. The project would cost $150,000. The marginal tax rate is 10%. The wdighted average cost of capital for the frrm is 9%. Explain the timdine with recevant cash flows (what is the cash flow for year 0 year 1 . and etc. Be sure to show redevant workd What is the net present value of this project? Do you accept or reject

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts