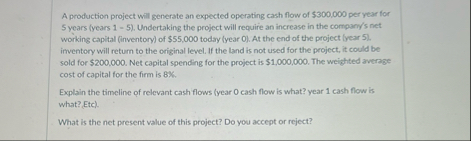

Question: A production project will generate an expected operating cash flow of $ 3 0 0 , 0 0 0 per year for Syears ( years

A production project will generate an expected operating cash flow of $ per year for Syears years Undertaking the project will require an increase in the company's net working capital inventory of $ today year At the end of the project year irventory will return to the original level. If the land is not used for the project, it could be sold for $ Net capital spending for the project is $ The weighted average cost of capital for the firm is K

Explain the timeline of relevant cash flows fyear cash flow is what? year cash flow is what? Etc

What is the net present value of this project? Do you accept or reject?A production project will generate an expected operating cash flow of $ per year for Syears years Undertaking the project will require an increase in the company's net working capital inventory of $ today year At the end of the project year irventory will return to the original level. If the land is not used for the project, it could be sold for $ Net capital spending for the project is $ The weighted average cost of capital for the firm is K

Explain the timeline of relevant cash flows fyear cash flow is what? year cash flow is what? Etc

What is the net present value of this project? Do you accept or reject?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock