Question: A profitable company is considering buying a new machine to increase its production capacity. Two options are being evaluated with the same estimated useful

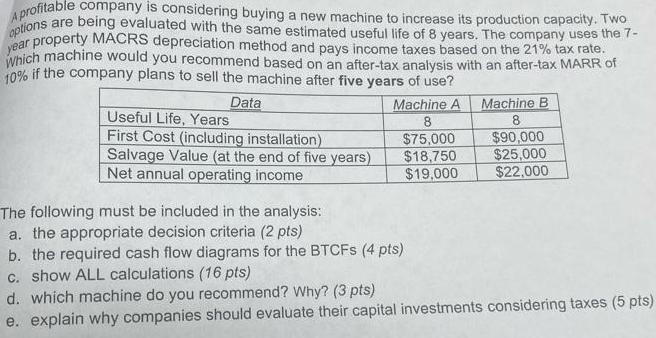

A profitable company is considering buying a new machine to increase its production capacity. Two options are being evaluated with the same estimated useful life of 8 years. The company uses the 7- year property MACRS depreciation method and pays income taxes based on the 21% tax rate Which machine would you recommend based on an after-tax analysis with an after-tax MARR of 10% if the company plans to sell the machine after five years of use? Data Useful Life, Years First Cost (including installation) Salvage Value (at the end of five years) Net annual operating income Machine A 8 $75,000 $18,750 $19,000 The following must be included in the analysis: a. the appropriate decision criteria (2 pts) b. the required cash flow diagrams for the BTCFs (4 pts) c. show ALL calculations (16 pts) Machine B 8 $90,000 $25,000 $22,000 d. which machine do you recommend? Why? (3 pts) e. explain why companies should evaluate their capital investments considering taxes (5 pts)

Step by Step Solution

3.48 Rating (155 Votes )

There are 3 Steps involved in it

a The appropriate decision criteria for this analysis are the Net Present Value NPV and the Internal Rate of Return IRR methods NPV calculates the pre... View full answer

Get step-by-step solutions from verified subject matter experts