Question: A program in C# visual studio that will calculate an individual federal income tax, based on gross income, deductions and simple tax table. Deductions include

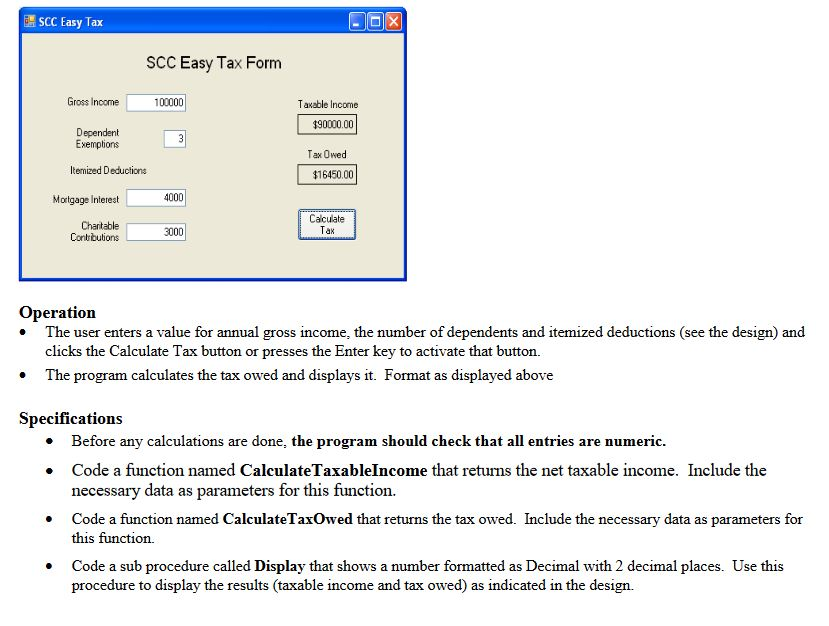

A program in C# visual studio that will calculate an individual federal income tax, based on gross income, deductions and simple tax table. Deductions include a standard exemption for dependents and a short list of allowablen itemized deductions. Below is a screen show of what the table will look like I have already made the table this is just for reference.

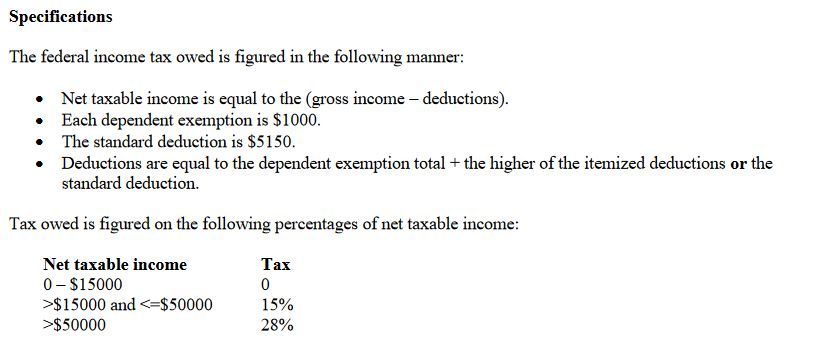

ESCC Easy Tax SCC Easy Tax Form Gross Income 100000 Taxable Income 190000.00 Dependent Exemptions Tax Owed ltemized Deductions $16450.00 Mortgage Interest 4000 Chantable Contributions Calculate Tax 3000 Operation . The user enters a value for annual gross income, the number of dependents and itemized deductions (see the design) and clicks the Calculate Tax button or presses the Enter key to activate that button. The program calculates the tax owed and displays it. Format as displayed above Specifications * Before any calculations are done, the program should check that all entries are numeric. . Code a function named CalculateTaxableIncome that returns the net taxable income. Include the necessary data as parameters for this function. Code a function named CalculateTaxOwed that returns the tax owed. Include the necessary data as parameters for this function. Code a sub procedure called Display that shows a number formatted as Decimal with 2 decimal places. Use this procedure to display the results (taxable income and tax owed) as indicated in the design. ESCC Easy Tax SCC Easy Tax Form Gross Income 100000 Taxable Income 190000.00 Dependent Exemptions Tax Owed ltemized Deductions $16450.00 Mortgage Interest 4000 Chantable Contributions Calculate Tax 3000 Operation . The user enters a value for annual gross income, the number of dependents and itemized deductions (see the design) and clicks the Calculate Tax button or presses the Enter key to activate that button. The program calculates the tax owed and displays it. Format as displayed above Specifications * Before any calculations are done, the program should check that all entries are numeric. . Code a function named CalculateTaxableIncome that returns the net taxable income. Include the necessary data as parameters for this function. Code a function named CalculateTaxOwed that returns the tax owed. Include the necessary data as parameters for this function. Code a sub procedure called Display that shows a number formatted as Decimal with 2 decimal places. Use this procedure to display the results (taxable income and tax owed) as indicated in the design

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts