Question: A progressive tax structure is one in which O a. everyone pays the same income tax rate. O b. the larger the amount of

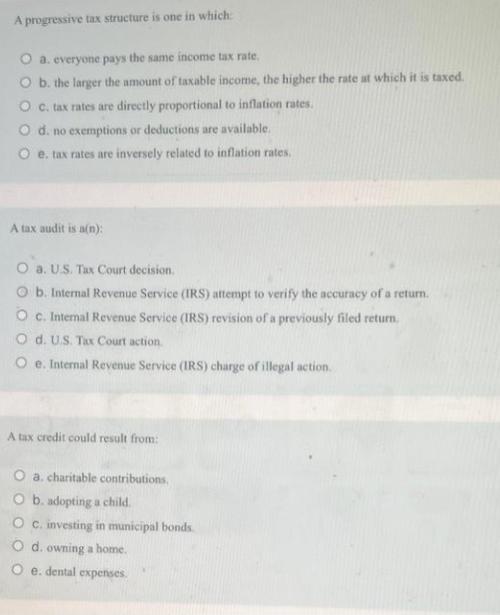

A progressive tax structure is one in which O a. everyone pays the same income tax rate. O b. the larger the amount of taxable income, the higher the rate at which it is taxed. O c. tax rates are directly proportional to inflation rates. O d. no exemptions or deductions are available. O e. tax rates are inversely related to inflation rates. A tax audit is a(n): O a. U.S. Tax Court decision. O b. Internal Revenue Service (IRS) attempt to verify the accuracy of a return. O c. Internal Revenue Service (IRS) revision of a previously filed return. O d. U.S. Tax Court action Oe. Internal Revenue Service (IRS) charge of illegal action. A tax credit could result from: O a. charitable contributions, O b. adopting a child. O c. investing in municipal bonds. O d. owning a home. O e. dental expenses.

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below A Progressive Tax Structure The answer ... View full answer

Get step-by-step solutions from verified subject matter experts