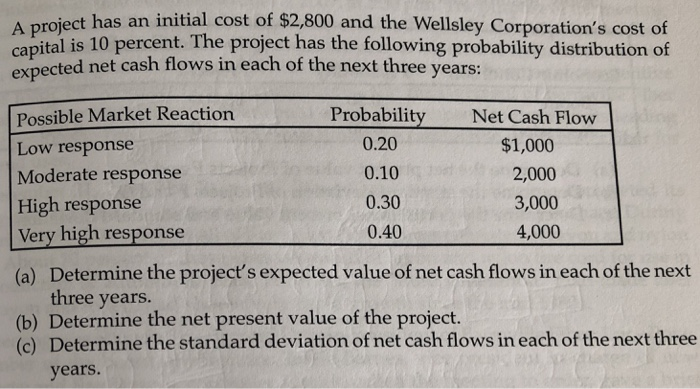

Question: A project has an initial cost expected net cash flows in each of the next three years: of $2,800 and the Wellsley Corporation's cost of

A project has an initial cost expected net cash flows in each of the next three years: of $2,800 and the Wellsley Corporation's cost of apital is 10 percent. The project has the following probability distribution of capi Possible Market Reaction Low response Moderate response High response Very high response (a) Determine the project's expected value of net cash flows in each of the next Probability 0.20 0.10 0.30 0.40 Net Cash Flow $1,000 2,000 3,000 4,000 three years. (b) Determine the net present value of the project (c) Determine the standard deviation of net cash flows in each of the next three years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts