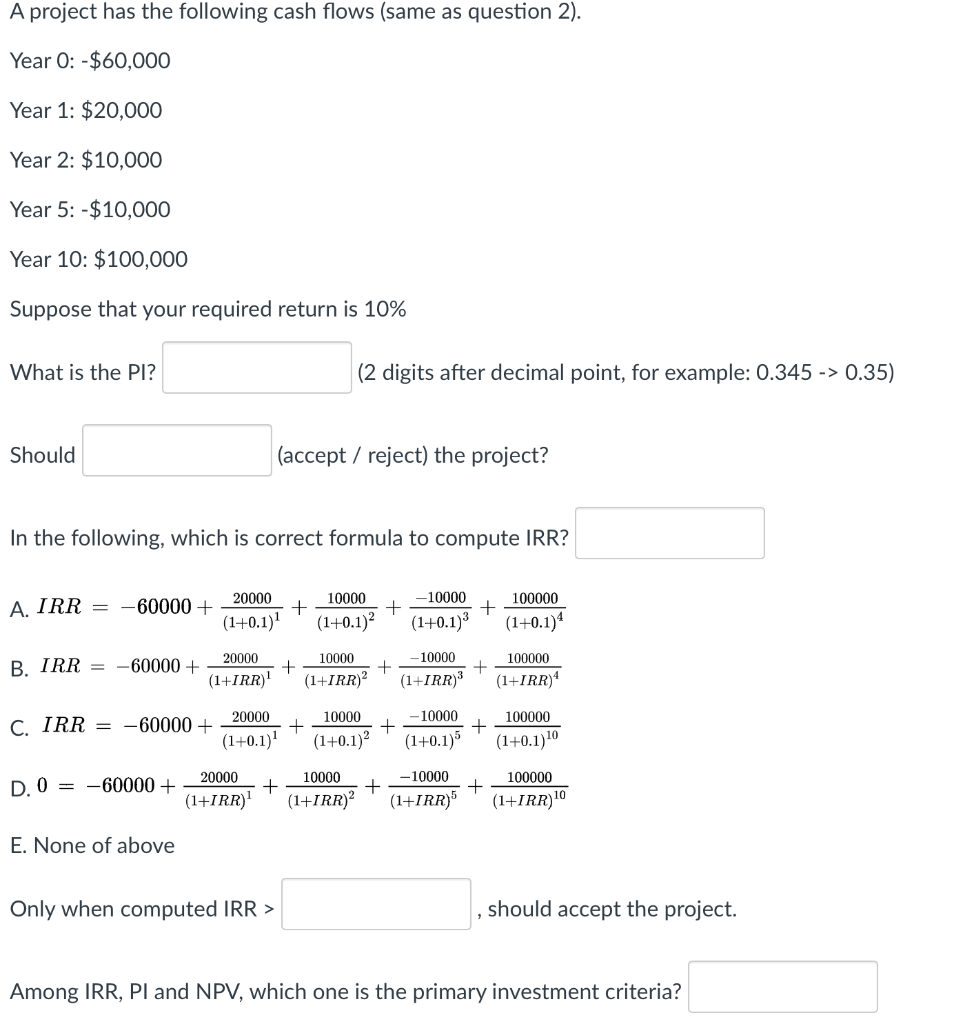

Question: A project has the following cash flows (same as question 2). Year 0:-$60,000 Year 1: $20,000 Year 2: $10,000 Year 5: -$10,000 Year 10: $100,000

A project has the following cash flows (same as question 2). Year 0:-$60,000 Year 1: $20,000 Year 2: $10,000 Year 5: -$10,000 Year 10: $100,000 Suppose that your required return is 10% What is the PI? (2 digits after decimal point, for example: 0.345 -> 0.35) Should (accept / reject) the project? In the following, which is correct formula to compute IRR? = -60000 + A. IRR 20000 (1+0.1) + -10000 10000 (1+0.1)? + + (1+0.1) 100000 (1+0.1) B. IRR = -60000 + 20000 (1+IRR) 10000 (1+IRR) 10000 (1+IRR)3 + 100000 (1+IRR) -10000 100000 C. IRR = -60000 + 20000 (1+0.1) + 10000 (1+0.1) (1+0.1) (1+0.1) 10 + 10000 (1+IRR) + D. O = -60000+ 20000 (1+IRR) -10000 (1+IRR)5 + 100000 (1+IRR)10 E. None of above Only when computed IRR > should accept the project. 9 Among IRR, PI and NPV, which one is the primary investment criteria

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts