Question: A project is expected to sell one million units each year at a price per unit of $16.50 and a cost per unit of $6.50.

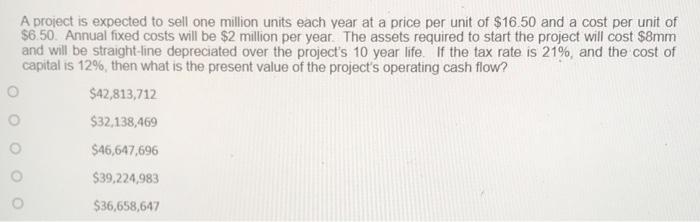

A project is expected to sell one million units each year at a price per unit of $16.50 and a cost per unit of $6.50. Annual fixed costs will be $2 million per year. The assets required to start the project will cost $8mm and will be straight-line depreciated over the project's 10 year life. If the tax rate is 21%, and the cost of capital is 12%, then what is the present value of the project's operating cash flow? $42,813,712 $32,138,469 $46,647,696 $39,224,983 $36,658,647

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock