Question: A project will require $380,100 for fixed assets, $152,600 for inventory, and $29,400 for accounts receivable. Short-term debt is expected to increase by $115,500. The

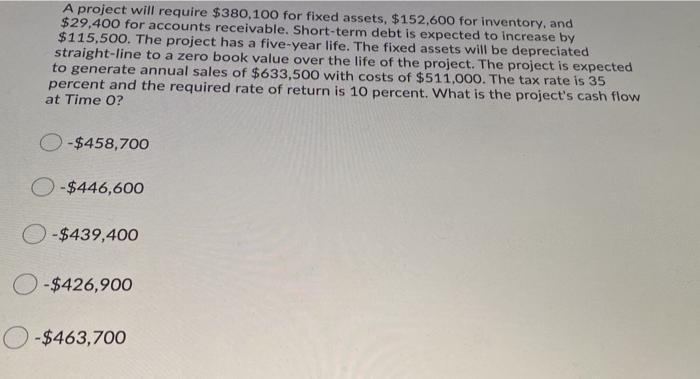

A project will require $380,100 for fixed assets, $152,600 for inventory, and $29,400 for accounts receivable. Short-term debt is expected to increase by $115,500. The project has a five-year life. The fixed assets will be depreciated straight-line to a zero book value over the life of the project. The project is expected to generate annual sales of $633,500 with costs of $511,000. The tax rate is 35 percent and the required rate of return is 10 percent. What is the project's cash flow at Time O? O-$458,700 O-$446,600 -$439,400 O-$426,900 -$463,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts