Question: A project will require $498,000 for fixed assets and $58,000 for net working capital. The fixed assets will be depreciated straight-line to a zero

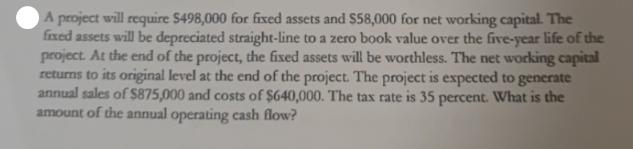

A project will require $498,000 for fixed assets and $58,000 for net working capital. The fixed assets will be depreciated straight-line to a zero book value over the five-year life of the project. At the end of the project, the fixed assets will be worthless. The net working capital returns to its original level at the end of the project. The project is expected to generate annual sales of $875,000 and costs of $640,000. The tax rate is 35 percent. What is the amount of the annual operating cash flow?

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

To calculate the annual operating cash flow we need to determine the annual earnings before ... View full answer

Get step-by-step solutions from verified subject matter experts