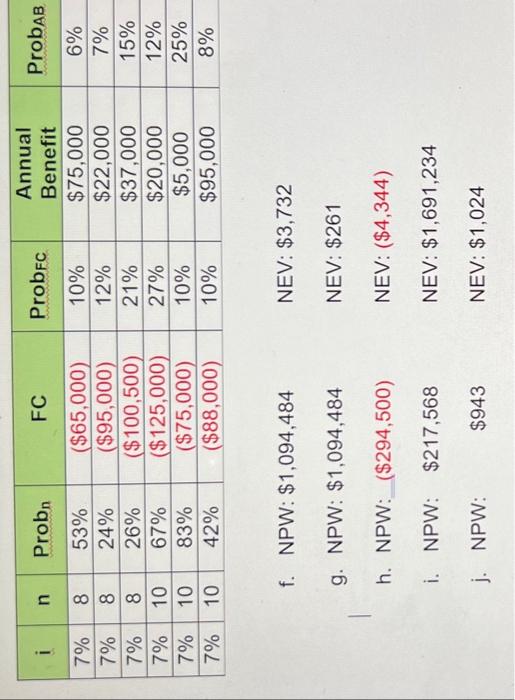

Question: A project with unceranties under consideration for implementation. The values are shown in the table below. What are the NET EXPECTED VALUE AND NET PRESENT

\begin{tabular}{|c|c|c|c|c|c|c|} \hline i & n & Probn & FC & Prob & Annual Benefit & ProbaB \\ \hline 7% & 8 & 53% & ($65,000) & 10% & $75,000 & 6% \\ \hline 7% & 8 & 24% & ($95,000) & 12% & $22,000 & 7% \\ \hline 7% & 8 & 26% & ($100,500) & 21% & $37,000 & 15% \\ \hline 7% & 10 & 67% & ($125,000) & 27% & $20,000 & 12% \\ \hline 7% & 10 & 83% & ($75,000) & 10% & $5,000 & 25% \\ \hline 7% & 10 & 42% & ($88,000) & 10% & $95,000 & 8% \\ \hline \end{tabular} f. NPW: $1,094,484 NEV: $3,732 g. NPW: $1,094,484 NEV: $261 h. NPW: ($294,500) NEV: ($4,344) i. NPW: $217,568 NEV: $1,691,234 j. NPW: $943 NEV: $1,024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts