Question: A proposed foreign investment involves a plant whose entire output of 1 million units per annum is to be exported. With a selling price of

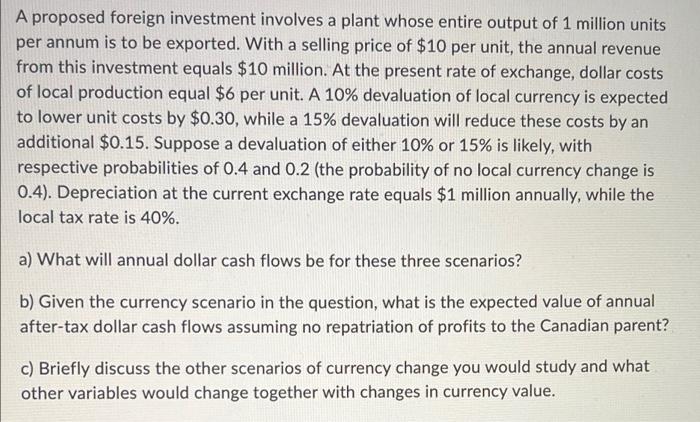

A proposed foreign investment involves a plant whose entire output of 1 million units per annum is to be exported. With a selling price of $10 per unit, the annual revenue from this investment equals $10 million. At the present rate of exchange, dollar costs of local production equal $6 per unit. A 10% devaluation of local currency is expected to lower unit costs by $0.30, while a 15% devaluation will reduce these costs by an additional $0.15. Suppose a devaluation of either 10% or 15% is likely, with respective probabilities of 0.4 and 0.2 (the probability of no local currency change is 0.4). Depreciation at the current exchange rate equals $1 million annually, while the local tax rate is 40%. a) What will annual dollar cash flows be for these three scenarios? b) Given the currency scenario in the question, what is the expected value of annual after-tax dollar cash flows assuming no repatriation of profits to the Canadian parent? c) Briefly discuss the other scenarios of currency change you would study and what other variables would change together with changes in currency value. A proposed foreign investment involves a plant whose entire output of 1 million units per annum is to be exported. With a selling price of $10 per unit, the annual revenue from this investment equals $10 million. At the present rate of exchange, dollar costs of local production equal $6 per unit. A 10% devaluation of local currency is expected to lower unit costs by $0.30, while a 15% devaluation will reduce these costs by an additional $0.15. Suppose a devaluation of either 10% or 15% is likely, with respective probabilities of 0.4 and 0.2 (the probability of no local currency change is 0.4). Depreciation at the current exchange rate equals $1 million annually, while the local tax rate is 40%. a) What will annual dollar cash flows be for these three scenarios? b) Given the currency scenario in the question, what is the expected value of annual after-tax dollar cash flows assuming no repatriation of profits to the Canadian parent? c) Briefly discuss the other scenarios of currency change you would study and what other variables would change together with changes in currency value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts