Question: A Public Utility owns and operates a Power Plant intended to be online indefinitely, needs replacing the old Power Generator with a new one. The

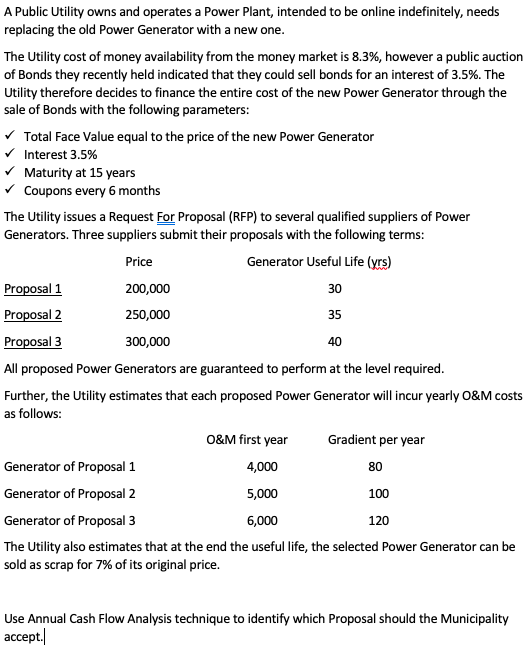

A Public Utility owns and operates a Power Plant intended to be online indefinitely, needs replacing the old Power Generator with a new one. The Utility cost of money availability from the money market is 8.3%, however a public auction of Bonds they recently held indicated that they could sell bonds for an interest of 3.5%. The Utility therefore decides to finance the entire cost of the new Power Generator through the sale of Bonds with the following parameters: Total Face Value equal to the price of the new Power Generator Interest 3.5% Maturity at 15 years Coupons every 6 months The Utility issues a Request For Proposal (RFP) to several qualified suppliers of Power Generators. Three suppliers submit their proposals with the following terms: Price Generator Useful Life (yrs) Proposal 1 200,000 30 Proposal 2 250,000 35 Proposal 3 300,000 40 All proposed Power Generators are guaranteed to perform at the level required. Further, the Utility estimates that each proposed Power Generator will incur yearly O&M costs as follows: O&M first year Gradient per year Generator of Proposal 1 4,000 Generator of Proposal 2 5,000 100 Generator of Proposal 3 6,000 120 The Utility also estimates that at the end the useful life, the selected Power Generator can be sold as scrap for 7% of its original price. 80 Use Annual Cash Flow Analysis technique to identify which Proposal should the Municipality accept.) A Public Utility owns and operates a Power Plant intended to be online indefinitely, needs replacing the old Power Generator with a new one. The Utility cost of money availability from the money market is 8.3%, however a public auction of Bonds they recently held indicated that they could sell bonds for an interest of 3.5%. The Utility therefore decides to finance the entire cost of the new Power Generator through the sale of Bonds with the following parameters: Total Face Value equal to the price of the new Power Generator Interest 3.5% Maturity at 15 years Coupons every 6 months The Utility issues a Request For Proposal (RFP) to several qualified suppliers of Power Generators. Three suppliers submit their proposals with the following terms: Price Generator Useful Life (yrs) Proposal 1 200,000 30 Proposal 2 250,000 35 Proposal 3 300,000 40 All proposed Power Generators are guaranteed to perform at the level required. Further, the Utility estimates that each proposed Power Generator will incur yearly O&M costs as follows: O&M first year Gradient per year Generator of Proposal 1 4,000 Generator of Proposal 2 5,000 100 Generator of Proposal 3 6,000 120 The Utility also estimates that at the end the useful life, the selected Power Generator can be sold as scrap for 7% of its original price. 80 Use Annual Cash Flow Analysis technique to identify which Proposal should the Municipality accept.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts