Question: A put option on the S&P 500 has an exercise price of 500 and a time to maturity of one year. The risk free rate

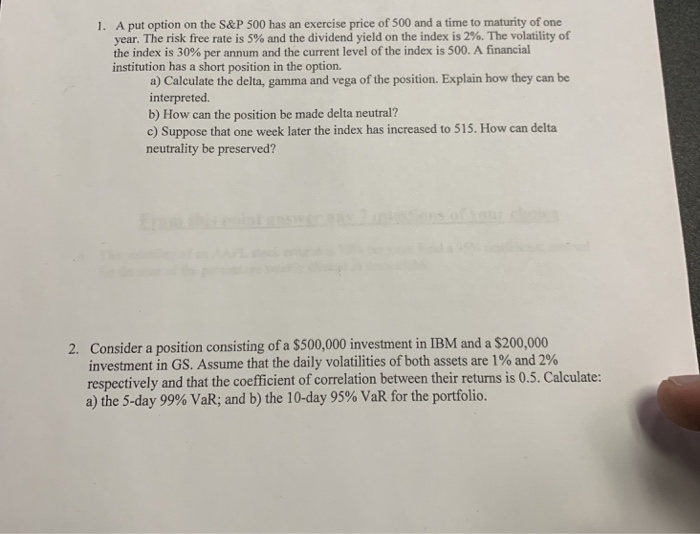

A put option on the S&P 500 has an exercise price of 500 and a time to maturity of one year. The risk free rate is 5% and the dividend yield on the index is 2%. The volatility of the index is 30% per annum and the current level of the index is 500, A financial institution has a short position in the option. 1. a) Calculate the delta, gamma and vega of the position. Explain how they can be interpreted. b) How can the position be made delta neutral? c) Suppose that one week later the index has increased to 515. How can delta neutrality be preserved? Consider a position consisting of a $500,000 investment in IBM and a $200,000 investment in GS. Assume that the daily volatilities of both assets are 1% and 2% respectively and that the coefficient of correlation between their returns is 0.5. Calculate: a) the 5-day 99% VaR, and b) the 10-day 95% VaR for the portfolio. 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts