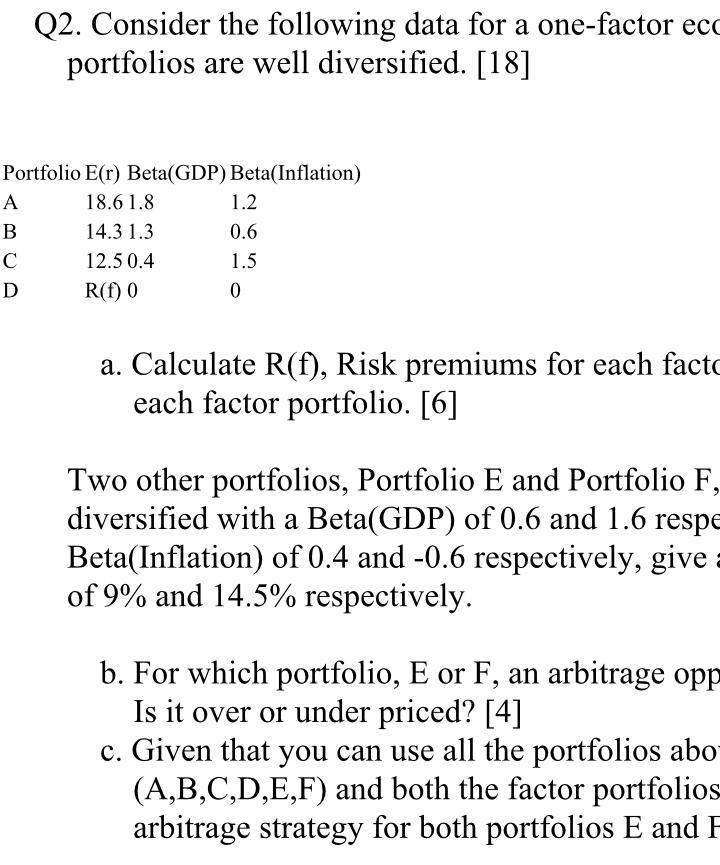

Question: a Q2. Consider the following data for a one-factor eco portfolios are well diversified. [18] Portfolio E(r) Beta(GDP) Beta(Inflation) A 18.6 1.8 1.2 . 14.3

a Q2. Consider the following data for a one-factor eco portfolios are well diversified. [18] Portfolio E(r) Beta(GDP) Beta(Inflation) A 18.6 1.8 1.2 . 14.3 1.3 0.6 12.5 0.4 1.5 D R(f) 0 0 a. Calculate R(f), Risk premiums for each facto each factor portfolio. [6] Two other portfolios, Portfolio E and Portfolio F, diversified with a Beta(GDP) of 0.6 and 1.6 respe Beta(Inflation) of 0.4 and -0.6 respectively, give of 9% and 14.5% respectively. b. For which portfolio, E or F, an arbitrage opp Is it over or under priced? [4] c. Given that you can use all the portfolios abo (A,B,C,D,E,F) and both the factor portfolios arbitrage strategy for both portfolios E and I a Q2. Consider the following data for a one-factor eco portfolios are well diversified. [18] Portfolio E(r) Beta(GDP) Beta(Inflation) A 18.6 1.8 1.2 . 14.3 1.3 0.6 12.5 0.4 1.5 D R(f) 0 0 a. Calculate R(f), Risk premiums for each facto each factor portfolio. [6] Two other portfolios, Portfolio E and Portfolio F, diversified with a Beta(GDP) of 0.6 and 1.6 respe Beta(Inflation) of 0.4 and -0.6 respectively, give of 9% and 14.5% respectively. b. For which portfolio, E or F, an arbitrage opp Is it over or under priced? [4] c. Given that you can use all the portfolios abo (A,B,C,D,E,F) and both the factor portfolios arbitrage strategy for both portfolios E and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts