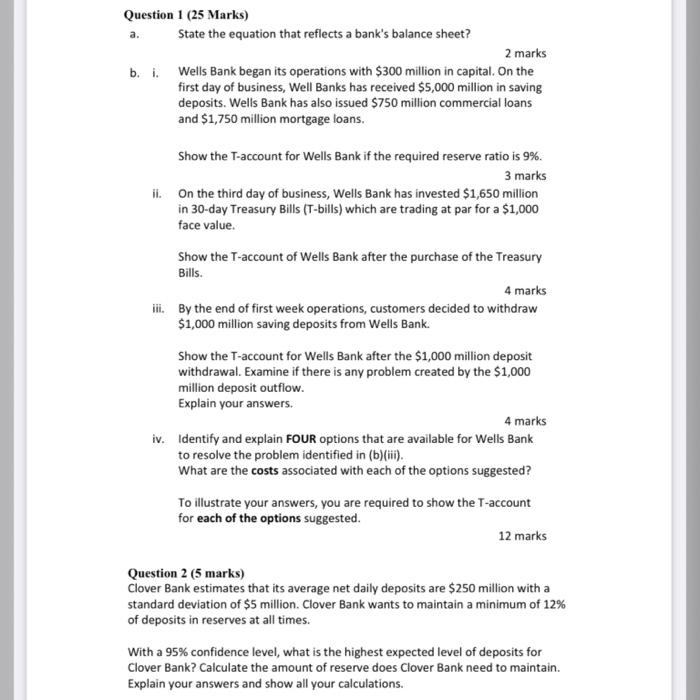

Question: a. Question 1 (25 Marks) State the equation that reflects a bank's balance sheet? 2 marks b. i. Wells Bank began its operations with $300

a. Question 1 (25 Marks) State the equation that reflects a bank's balance sheet? 2 marks b. i. Wells Bank began its operations with $300 million in capital. On the first day of business, Well Banks has received $5,000 million in saving deposits. Wells Bank has also issued $750 million commercial loans and $1,750 million mortgage loans. Show the T-account for Wells Bank if the required reserve ratio is 9%. 3 marks ii. On the third day of business, Wells Bank has invested $1,650 million in 30-day Treasury Bills (T-bills) which are trading at par for a $1,000 face value. Show the T-account of Wells Bank after the purchase of the Treasury Bills. 4 marks iii. By the end of first week operations, customers decided to withdraw $1,000 million saving deposits from Wells Bank. Show the T-account for Wells Bank after the $1,000 million deposit withdrawal. Examine if there is any problem created by the $1,000 million deposit outflow. Explain your answers. 4 marks iv. Identify and explain FOUR options that are available for Wells Bank to resolve the problem identified in (b)(ii). What are the costs associated with each of the options suggested? To illustrate your answers, you are required to show the T-account for each of the options suggested. 12 marks Question 2 (5 marks) Clover Bank estimates that its average net daily deposits are $250 million with a standard deviation of $5 million. Clover Bank wants to maintain a minimum of 12% of deposits in reserves at all times. With a 95% confidence level, what is the highest expected level of deposits for Clover Bank? Calculate the amount of reserve does Clover Bank need to maintain. Explain your answers and show all your calculations. a. Question 1 (25 Marks) State the equation that reflects a bank's balance sheet? 2 marks b. i. Wells Bank began its operations with $300 million in capital. On the first day of business, Well Banks has received $5,000 million in saving deposits. Wells Bank has also issued $750 million commercial loans and $1,750 million mortgage loans. Show the T-account for Wells Bank if the required reserve ratio is 9%. 3 marks ii. On the third day of business, Wells Bank has invested $1,650 million in 30-day Treasury Bills (T-bills) which are trading at par for a $1,000 face value. Show the T-account of Wells Bank after the purchase of the Treasury Bills. 4 marks iii. By the end of first week operations, customers decided to withdraw $1,000 million saving deposits from Wells Bank. Show the T-account for Wells Bank after the $1,000 million deposit withdrawal. Examine if there is any problem created by the $1,000 million deposit outflow. Explain your answers. 4 marks iv. Identify and explain FOUR options that are available for Wells Bank to resolve the problem identified in (b)(ii). What are the costs associated with each of the options suggested? To illustrate your answers, you are required to show the T-account for each of the options suggested. 12 marks Question 2 (5 marks) Clover Bank estimates that its average net daily deposits are $250 million with a standard deviation of $5 million. Clover Bank wants to maintain a minimum of 12% of deposits in reserves at all times. With a 95% confidence level, what is the highest expected level of deposits for Clover Bank? Calculate the amount of reserve does Clover Bank need to maintain. Explain your answers and show all your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts