Question: a Question 1 (True or False): Empirically, hostile takeovers are far more common than friendly deals. (1 point) Question 2 (True or False): A bear

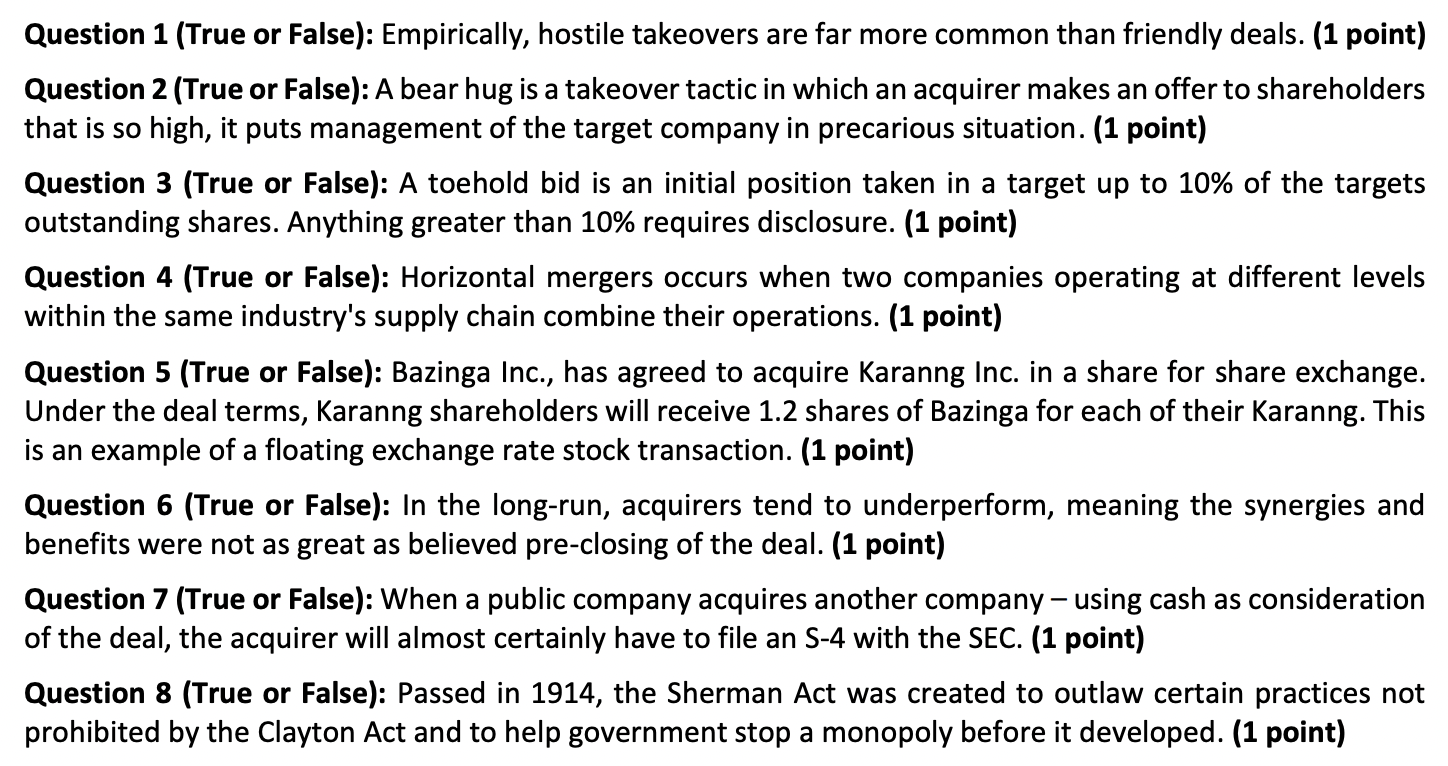

a Question 1 (True or False): Empirically, hostile takeovers are far more common than friendly deals. (1 point) Question 2 (True or False): A bear hug is a takeover tactic in which an acquirer makes an offer to shareholders that is so high, it puts management of the target company in precarious situation. (1 point) Question 3 (True or False): A toehold bid is an initial position taken in a target up to 10% of the targets outstanding shares. Anything greater than 10% requires disclosure. (1 point) Question 4 (True or False): Horizontal mergers occurs when two companies operating at different levels within the same industry's supply chain combine their operations. (1 point) Question 5 (True or False): Bazinga Inc., has agreed to acquire Karanng Inc. in a share for share exchange. Under the deal terms, Karanng shareholders will receive 1.2 shares of Bazinga for each of their Karanng. This is an example of a floating exchange rate stock transaction. (1 point) Question 6 (True or False): In the long-run, acquirers tend to underperform, meaning the synergies and benefits were not as great as believed pre-closing of the deal. (1 point) Question 7 (True or False): When a public company acquires another company - using cash as consideration of the deal, the acquirer will almost certainly have to file an S-4 with the SEC. (1 point) Question 8 (True or False): Passed in 1914, the Sherman Act was created to outlaw certain practices not prohibited by the Clayton Act and to help government stop a monopoly before it developed. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts