Question: A QUESTION HAVING TWO OR MORE PARTS WILL BE COUNTED AS ONE QUESTION L MULTIPLE CHOICE QUESTIONS (1-20 are worth 2 points each) 1. Name

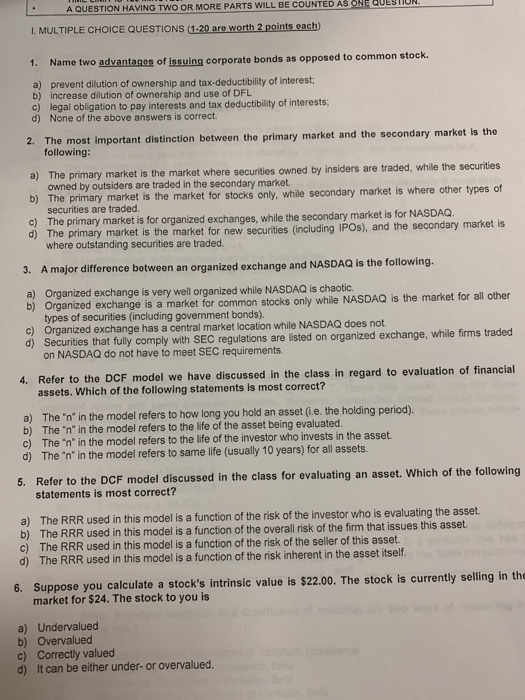

A QUESTION HAVING TWO OR MORE PARTS WILL BE COUNTED AS ONE QUESTION L MULTIPLE CHOICE QUESTIONS (1-20 are worth 2 points each) 1. Name two advantages of issuing corporate bonds as opposed to common stock. a) prevent dilution of ownership and tax-deductibility of interest b) increase dilution of ownership and use of DFL c) legal obligation to pay interests and tax deductibility of interests d) None of the above answers is correct. 2. The most important distinction between the primary market and the secondary market is the following: a) The primary market is the market where securities owned by insiders are traded, while the securities owned by outsiders are traded in the secondary market. b) The primary market is the market for stocks only, while secondary market is where other types of Securities are traded. c) The primary market is for organized exchanges, while the secondary market is for NASDAQ d) The primary market is the market for new securities (including IPOs), and the secondary market is where outstanding securities are traded. 3. A major difference between an organized exchange and NASDAQ is the following. a) Organized exchange is very well organized while NASDAQ is chaotic. b) Organized exchange is a market for common stocks only while NASDAQ is the market for all other types of securities (including government bonds). c) Organized exchange has a central market location while NASDAQ does not d) Securities that fully comply with SEC regulations are listed on organized exchange, while firms traded on NASDAQ do not have to meet SEC requirements 4. Refer to the DCF model we have discussed in the class in regard to evaluation of financial assets. Which of the following statements is most correct? a) The 'n' in the model refers to how long you hold an asset (ie the holding period). b) The "n" in the model refers to the life of the asset being evaluated. c) The "n" in the model refers to the life of the investor who invests in the asset. d) The "n" in the model refers to same life (usually 10 years) for all assets. 5. Refer to the DCF model discussed in the class for evaluating an asset. Which of the following statements is most correct? a) The RRR used in this model is a function of the risk of the investor who is evaluating the asset. b) The RRR used in this model is a function of the overall risk of the firm that issues this asset. c) The RRR used in this model is a function of the risk of the seller of this asset. d) The RRR used in this model is a function of the risk inherent in the asset itself. 6. Suppose you calculate a stock's intrinsic value is $22.00. The stock is currently selling in thi market for $24. The stock to you is a) Undervalued b) Overvalued c) Correctly valued d) It can be either under-or overvalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts