Question: A Question number 14 II. Problems (40 points) Answer each of the questions below completely. Show all your work. 13. (8 points) You own a

A

Question number 14

Question number 14

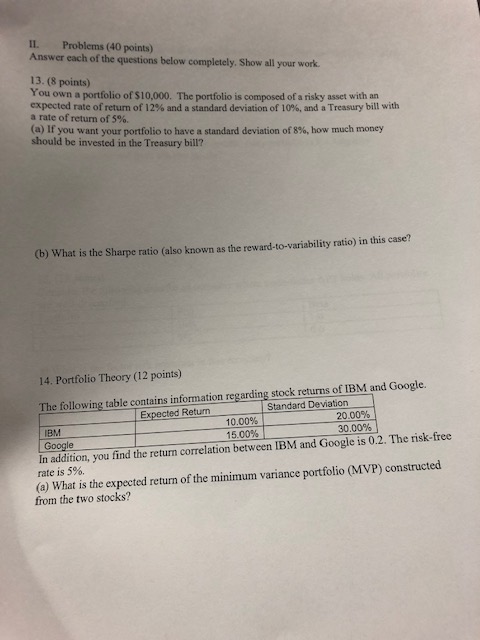

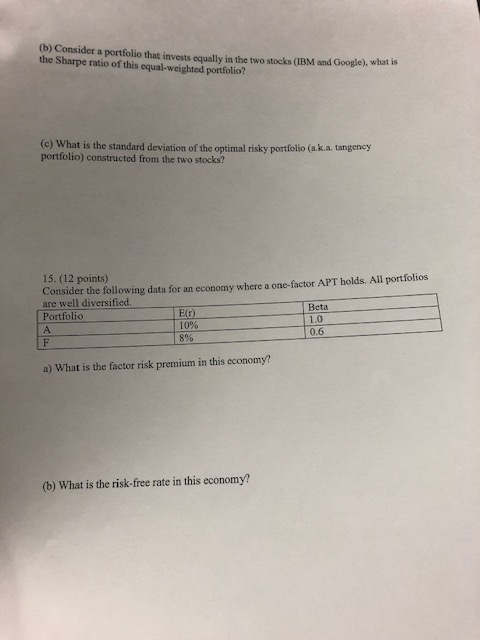

II. Problems (40 points) Answer each of the questions below completely. Show all your work. 13. (8 points) You own a portfolio of $10,000. The portfolio is composed of a risky asset with an expected rate of return of 12% and a standard deviation of 10%, and a Treasury bill with (a) If youretum of 5% of 12% and a portfolio is co (a) If you want your portfolio to have a standard deviation of 8%, how much money should be invested in the Treasury bill? (b) What is the Sharpe ratio (also known as the reward-to-variability ratio) in this case? 14. Portfolio Theory (12 points) 16.00% 20,00% The following table contains information regarding stock returns of IBM and Google. Expected Return Standard Deviation 10.00% 20.00% Google 15.00% 30.00% In addition, you find the return correlation between IBM and Google is 0.2. The risk-free rate is 5%. (a) What is the expected return of the minimum variance portfolio (MVP) constructed from the two stocks? Consider a portfolio that invests equally in the two Mocks (IBM and Google), what the Sharpe ratio of this equal weighted portfolio? (c) What is the standard deviation of the optimal risky portfolio (sk.a. tangency portfolio) constructed from the two stocks? 15. (12 points) Consider the following data for an economy where a one-factor APT holds. All portiollos are well diversified Portfolio E ) Beta 10 1.0 0.6 a) What is the factor risk premium in this economy? (b) What is the risk-free rate in this economy? II. Problems (40 points) Answer each of the questions below completely. Show all your work. 13. (8 points) You own a portfolio of $10,000. The portfolio is composed of a risky asset with an expected rate of return of 12% and a standard deviation of 10%, and a Treasury bill with (a) If youretum of 5% of 12% and a portfolio is co (a) If you want your portfolio to have a standard deviation of 8%, how much money should be invested in the Treasury bill? (b) What is the Sharpe ratio (also known as the reward-to-variability ratio) in this case? 14. Portfolio Theory (12 points) 16.00% 20,00% The following table contains information regarding stock returns of IBM and Google. Expected Return Standard Deviation 10.00% 20.00% Google 15.00% 30.00% In addition, you find the return correlation between IBM and Google is 0.2. The risk-free rate is 5%. (a) What is the expected return of the minimum variance portfolio (MVP) constructed from the two stocks? Consider a portfolio that invests equally in the two Mocks (IBM and Google), what the Sharpe ratio of this equal weighted portfolio? (c) What is the standard deviation of the optimal risky portfolio (sk.a. tangency portfolio) constructed from the two stocks? 15. (12 points) Consider the following data for an economy where a one-factor APT holds. All portiollos are well diversified Portfolio E ) Beta 10 1.0 0.6 a) What is the factor risk premium in this economy? (b) What is the risk-free rate in this economy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts