Question: A question on Financial Math. Please show step by step. Thank you so much!!! The following table shows the market information of three bonds: Market

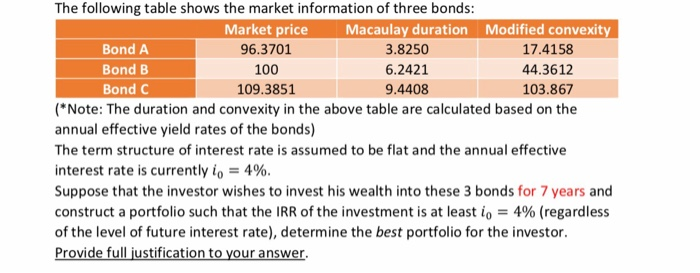

The following table shows the market information of three bonds: Market price 96.3701 100 109.3851 Bond A Bond B Bond C Macaulay duration 3.8250 6.2421 9.4408 Modified convexity 17.4158 44.3612 103.867 *Note: The duration and convexity in the above table are calculated based on the annual effective yield rates of the bonds) The term structure of interest rate is assumed to be flat and the annual effective interest rate is currently io-496. Suppose that the investor wishes to invest his wealth into these 3 bonds for 7 years and construct a portfolio such that the IRR of the investment is at least io-4% (regardless of the level of future interest rate), determine the best portfolio for the investor. Provide full justification to your answer The following table shows the market information of three bonds: Market price 96.3701 100 109.3851 Bond A Bond B Bond C Macaulay duration 3.8250 6.2421 9.4408 Modified convexity 17.4158 44.3612 103.867 *Note: The duration and convexity in the above table are calculated based on the annual effective yield rates of the bonds) The term structure of interest rate is assumed to be flat and the annual effective interest rate is currently io-496. Suppose that the investor wishes to invest his wealth into these 3 bonds for 7 years and construct a portfolio such that the IRR of the investment is at least io-4% (regardless of the level of future interest rate), determine the best portfolio for the investor. Provide full justification to your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts