Question: a) Read this article and explain what ISAs are (don't need answer to this) b) Attending school costs $160,000 total right now, after scholarships. This

-

a) Read this article and explain what ISAs are (don't need answer to this)

-

b) Attending school costs $160,000 total right now, after scholarships. This would pay for your full education. You expect to make $80,000 every year once you graduate. You have two options to finance this: Student loans or income-sharing agreements. If you take out a student loan, you want to take out $160,000 right now, and you have to start paying it back at the end of the year (at t =1). As in question 2, you want to make equal payments, but this time, annually. How much do you have to pay if you want to be done paying off your student loans 26 years after your graduation? (I.e. in 30 years from now)3? Assume an interest rate of 7%.

-

c) If you take out an income-sharing agreement (ISA), you will be required to pay 20% of your income every year for the first 15 years after graduation (i.e. from t = 5 to t = 20). Is this a better offer than taking out a loan? Keep using the 7% interest rate.

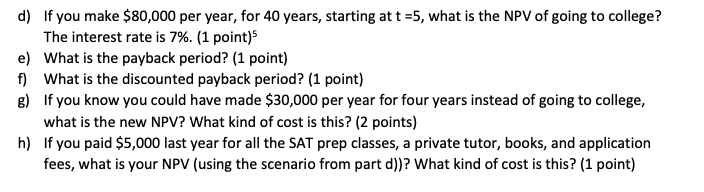

d) If you make $80,000 per year, for 40 years, starting at t =5, what is the NPV of going to college? The interest rate is 7%. (1 point) e) What is the payback period? (1 point) f) What is the discounted payback period? (1 point) g) If you know you could have made $30,000 per year for four years instead of going to college, what is the new NPV? What kind of cost is this? (2 points) h) If you paid $5,000 last year for all the SAT prep classes, a private tutor, books, and application fees, what is your NPV (using the scenario from part d))? What kind of cost is this? (1 point) d) If you make $80,000 per year, for 40 years, starting at t =5, what is the NPV of going to college? The interest rate is 7%. (1 point) e) What is the payback period? (1 point) f) What is the discounted payback period? (1 point) g) If you know you could have made $30,000 per year for four years instead of going to college, what is the new NPV? What kind of cost is this? (2 points) h) If you paid $5,000 last year for all the SAT prep classes, a private tutor, books, and application fees, what is your NPV (using the scenario from part d))? What kind of cost is this? (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts