Question: A real estate agent is approached by a client who is deciding whether or not to sell her home. She purchased it in 2017 for

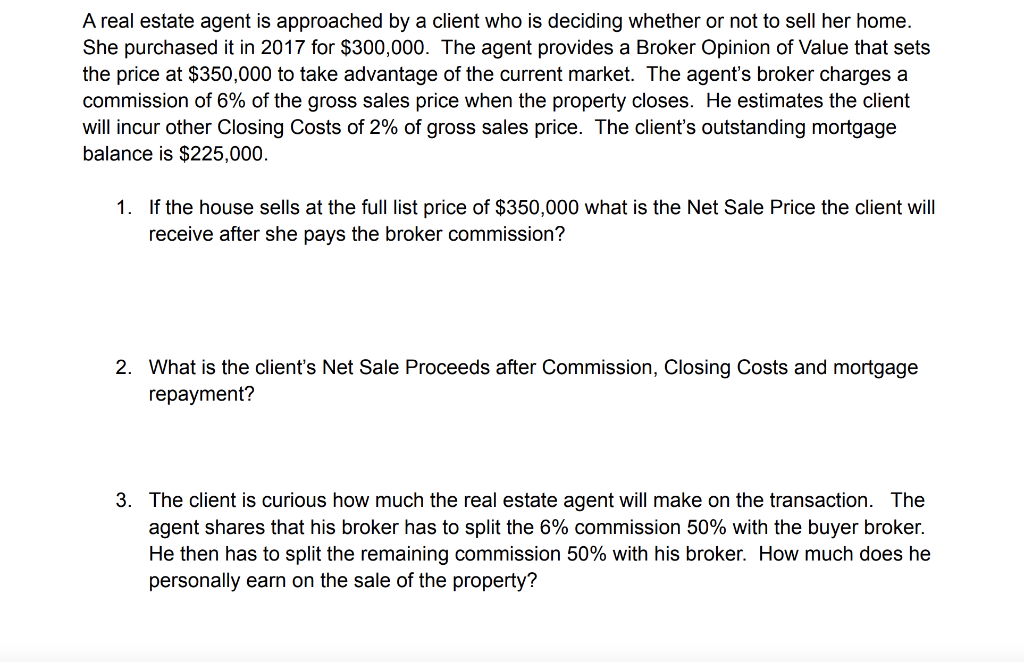

A real estate agent is approached by a client who is deciding whether or not to sell her home. She purchased it in 2017 for $300,000. The agent provides a Broker Opinion of Value that sets the price at $350,000 to take advantage of the current market. The agent's broker charges a commission of 6% of the gross sales price when the property closes. He estimates the client will incur other Closing Costs of 2% of gross sales price. The client's outstanding mortgage balance is $225,000. 1. If the house sells at the full list price of $350,000 what is the Net Sale Price the client will receive after she pays the broker commission? 2. What is the client's Net Sale Proceeds after Commission, Closing Costs and mortgage repayment? 3. The client is curious how much the real estate agent will make on the transaction. The agent shares that his broker has to split the 6% commission 50% with the buyer broker. He then has to split the remaining commission 50% with his broker. How much does he personally earn on the sale of the property

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts