Question: A real estate developer in Lebanon is constructing a building in downtown Beirut and is considering two mutually exclusive projects (A & B). Project A

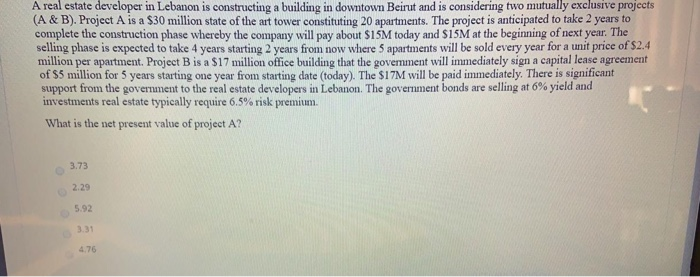

A real estate developer in Lebanon is constructing a building in downtown Beirut and is considering two mutually exclusive projects (A & B). Project A is a $30 million state of the art tower constituting 20 apartments. The project is anticipated to take 2 years to complete the construction phase whereby the company will pay about $15M today and $15M at the beginning of next year. The selling phase is expected to take 4 years starting 2 years from now where 5 apartments will be sold every year for a unit price of $2.4 million per apartment. Project B is a $17 million office building that the government will immediately sign a capital lease agreement of $5 million for 5 years starting one year from starting date (today). The $17M will be paid immediately. There is significant support from the government to the real estate developers in Lebanon. The government bonds are selling at % yield and investments real estate typically require 6.5% risk premium. What is the net present value of project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts