Question: A) Record the basic consolidation entry. Record the entry to defer this year's unrealized profit on inventory transfers. B)Prepare a consolidated balance sheet worksheet as

A)

A)

- Record the basic consolidation entry.

- Record the entry to defer this year's unrealized profit on inventory transfers.

B)Prepare a consolidated balance sheet worksheet as of December 31, 20X8.

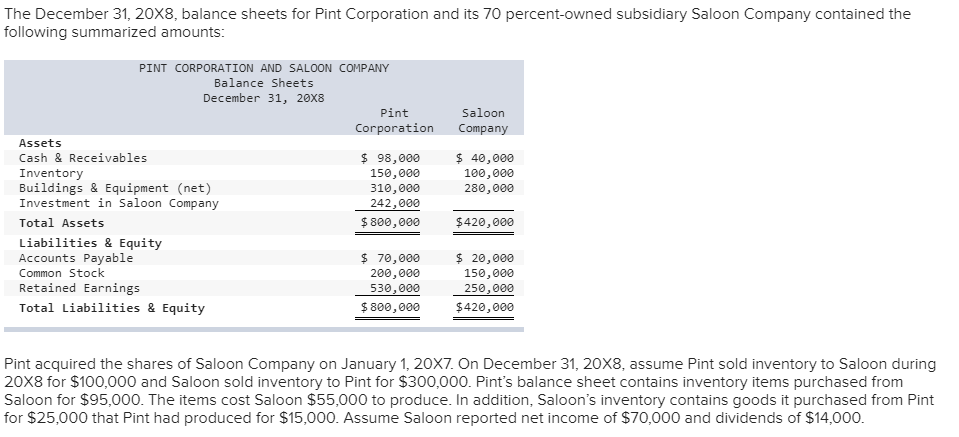

The December 31, 20X8, balance sheets for Pint Corporation and its 70 percent-owned subsidiary Saloon Company contained the following summarized amounts PINT CORPORATION AND SALOON COMPANY Balance Sheets December 31, 20x8 Pint Saloon Corporation Company Assets Cash & Receivables Inventory Buildings & Equipment (net) Investment in Saloon Company Total Assets $ 98,000 150,000 310,000 242,000 $800,000 $ 40,000 100,000 280,000 $420,000 Liabilities & Equity Accounts Payable Common Stock Retained Earnings $ 70,000 200,000 530,000 $ 800,000 $ 20,000 150,000 250,000 $420,000 Total Liabilities& Equity Pint acquired the shares of Saloon Company on January 1, 20X7. On December 31, 20X8, assume Pint sold inventory to Saloon during 20X8 for $100,000 and Saloon sold inventory to Pint for $300,000. Pint's balance sheet contains inventory items purchased from Saloon for $95,000. The items cost Saloon $55,000 to produce. In addition, Saloon's inventory contains goods it purchased from Pint for $25,000 that Pint had produced for $15,000. Assume Saloon reported net income of $70,000 and dividends of $14,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts