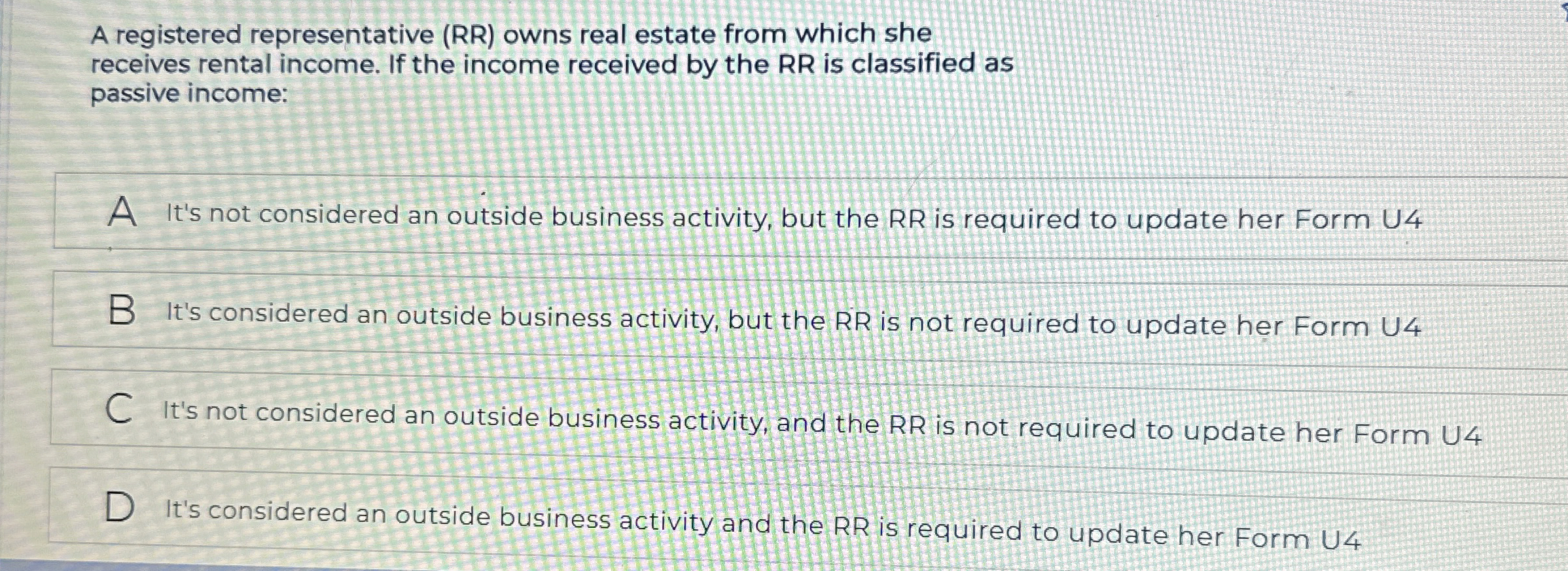

Question: A registered representative ( RR ) owns real estate from which she receives rental income. If the income received by the RR is classified as

A registered representative RR owns real estate from which she

receives rental income. If the income received by the RR is classified as

passive income:

A

It's not considered an outside business activity, but the RR is required to update her form U

It's considered an outside business activity, but the RR is not required to update her form U

It's not considered an outside business activity, and the RR is not required to update her Form

It's considered an outside business activity and the RR is required to update her Form U

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock