Question: A relatively small medical group practice is trying to estimate its corporate cost of capital. The practice is 100 percent equity financed. The rate of

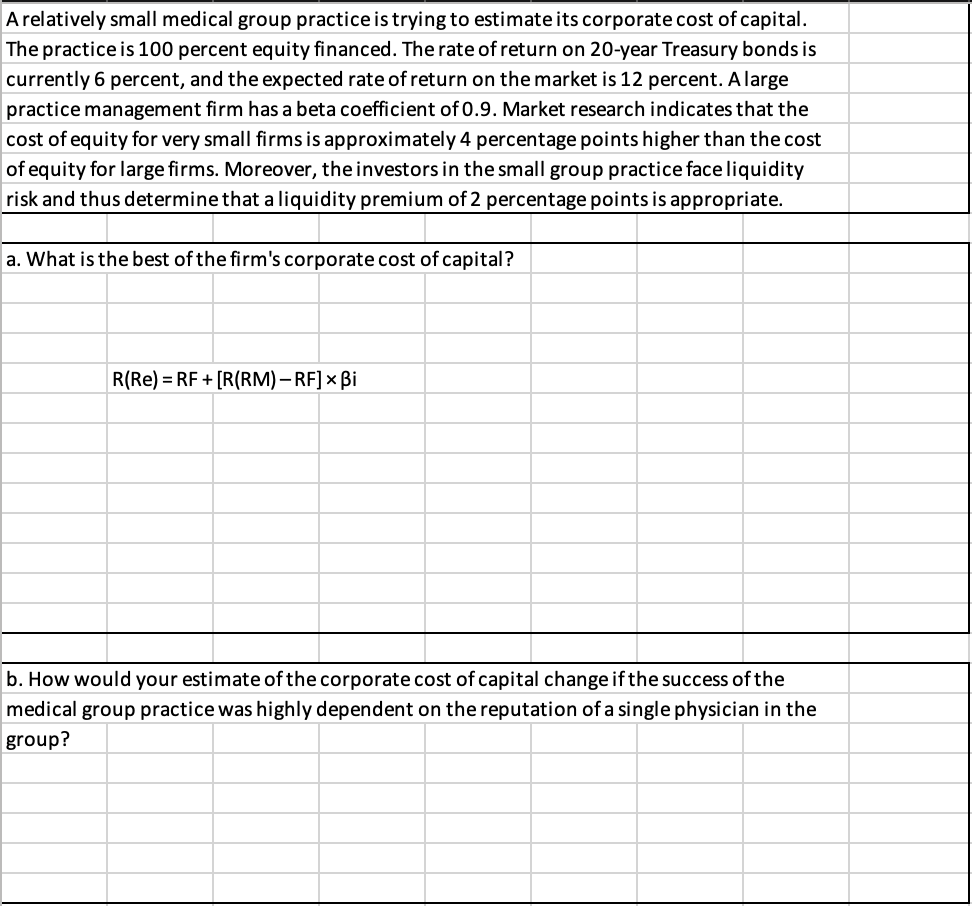

A relatively small medical group practice is trying to estimate its corporate cost of capital. The practice is 100 percent equity financed. The rate of return on 20-year Treasury bonds is currently 6 percent, and the expected rate of return on the market is 12 percent. A large practice management firm has a beta coefficient of 0.9. Market research indicates that the cost of equity for very small firms is approximately 4 percentage points higher than the cost of equity for large firms. Moreover, the investors in the small group practice face liquidity risk and thus determine that a liquidity premium of 2 percentage points is appropriate. a. What is the best of the firm's corporate cost of capital? R(Re) = RF+ [R(RM) - RF] Bi b. How would your estimate of the corporate cost of capital change if the success of the medical group practice was highly dependent on the reputation of a single physician in the group

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts