Question: A restaurant chain is thinking about opening up a pop-up restaurant that it will run for two years. For both years, the restaurant will

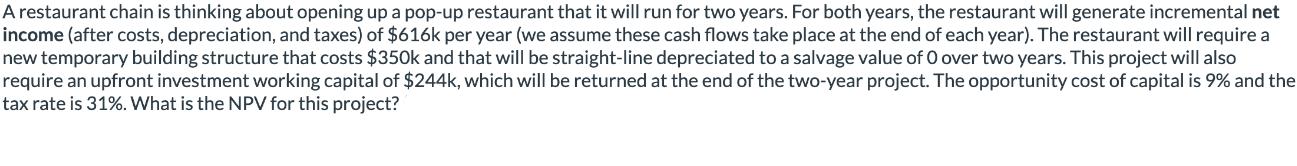

A restaurant chain is thinking about opening up a pop-up restaurant that it will run for two years. For both years, the restaurant will generate incremental net income (after costs, depreciation, and taxes) of $616k per year (we assume these cash flows take place at the end of each year). The restaurant will require a new temporary building structure that costs $350k and that will be straight-line depreciated to a salvage value of 0 over two years. This project will also require an upfront investment working capital of $244k, which will be returned at the end of the two-year project. The opportunity cost of capital is 9% and the tax rate is 31%. What is the NPV for this project?

Step by Step Solution

There are 3 Steps involved in it

To calculate the NPV of the popup restaurant project we need to determine the cash flows for each ye... View full answer

Get step-by-step solutions from verified subject matter experts