Question: A restaurant is considering buying a new coffee making machine, which will be replaced over and over with a new one when an old one

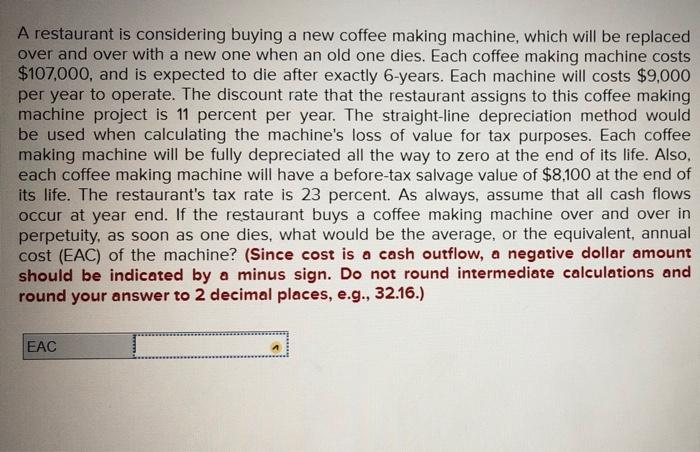

A restaurant is considering buying a new coffee making machine, which will be replaced over and over with a new one when an old one dies. Each coffee making machine costs $107.000, and is expected to die after exactly 6-years. Each machine will costs $9,000 per year to operate. The discount rate that the restaurant assigns to this coffee making machine project is 11 percent per year. The straight-line depreciation method would be used when calculating the machine's loss of value for tax purposes. Each coffee making machine will be fully depreciated all the way to zero at the end of its life. Also, each coffee making machine will have a before-tax salvage value of $8,100 at the end of its life. The restaurant's tax rate is 23 percent. As always, assume that all cash flows occur at year end. If the restaurant buys a coffee making machine over and over in perpetuity, as soon as one dies, what would be the average, or the equivalent, annual cost (EAC) of the machine? (Since cost is a cash outflow, a negative dollar amount should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) EAC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts