Question: a riolearn.org Tool GBS132 - Lesson 10 1. Using the mitral fund quotes in Exhibit 13.3 from the textbook, and assuming you can buy these

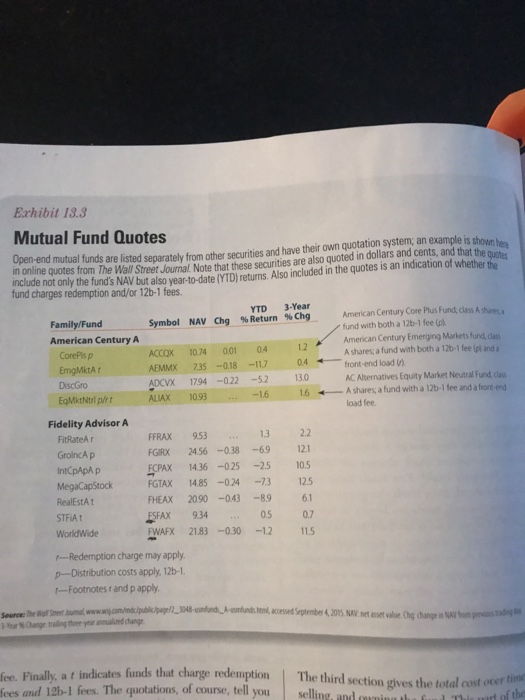

a riolearn.org Tool GBS132 - Lesson 10 1. Using the mitral fund quotes in Exhibit 13.3 from the textbook, and assuming you can buy these funds at their quoted NAVs, how much would you have to pay to buy each of the following funds? a. FWAFX b. ADCVX C. FCPAXX d. FSFA)X According to the quotes, which of these four funds have 12b-1 fees? Which have redemption fees? Are any of them no loads? Which fund has the highest year-to-date return? Which has the lowest? 2. For each pair of funds listed below, select the fund that would be the least risky and briefly explain your answer. a. Growth versus growth-and-income. uihincome yersus high-grade corporate bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts