Question: A. Ron's pension adjustment is calculated based on the defined benefit provision of his pension plan. The formula for this is 9 times the defined

A. Ron's pension adjustment is calculated based on the defined benefit provision of his pension plan. The formula for this is 9 times the defined benefit provision minus $600. In this case, Ron's defined benefit provision is 2% of his career average earnings times his years of service.

Given that Ron has been a member of the pension plan since 1982 and it's now 2023, he has been a member for 41 years. If we assume his career average earnings are $80,000, the defined benefit provision is 0.02 * $80,000 * 41 = $65,600.

Therefore, the pension adjustment is 9 * $65,600 - $600 = $590,400.

B. Ron's RRSP contribution limit for the year is the lesser of 18% of his earned income for the previous year and the RRSP dollar limit for the year, minus his pension adjustment.

Assuming his earned income is $80,000, 18% of this is $14,400. The RRSP dollar limit for the year is $23,820. Given that his pension adjustment is $590,400, this is greater than either of these amounts. Therefore, his RRSP contribution limit for the year is zero.

C. Severance payments can be transferred to an RRSP without affecting the RRSP contribution room, but the amount that can be transferred tax-free is limited based on age and years of service. As of my knowledge cutoff in September 2021, the limit was $2,000 for each year or part of a year of service up to 1995, and $1,500 for each year of service before 1989 in which no accruals to a pension plan or deferred profit-sharing plan were made.

Without more information on Ron's age and his years of service prior to 1989 and 1995, I can't provide an exact figure. However, if he was eligible to transfer the maximum amount for each year of service since 1980, this would be $30,000 for the years 1980-1995 (16 years * $2,000) and $42,000 for the years 1996-2023 (28 years * $1,500), for a total of $72,000.

As the severance allowance of $50,000 is less than this, he should be able to roll over the entire amount into his RRSP, provided he has sufficient contribution room. However, this will not be possible if his RRSP contribution limit for the year is zero, as calculated in part B.

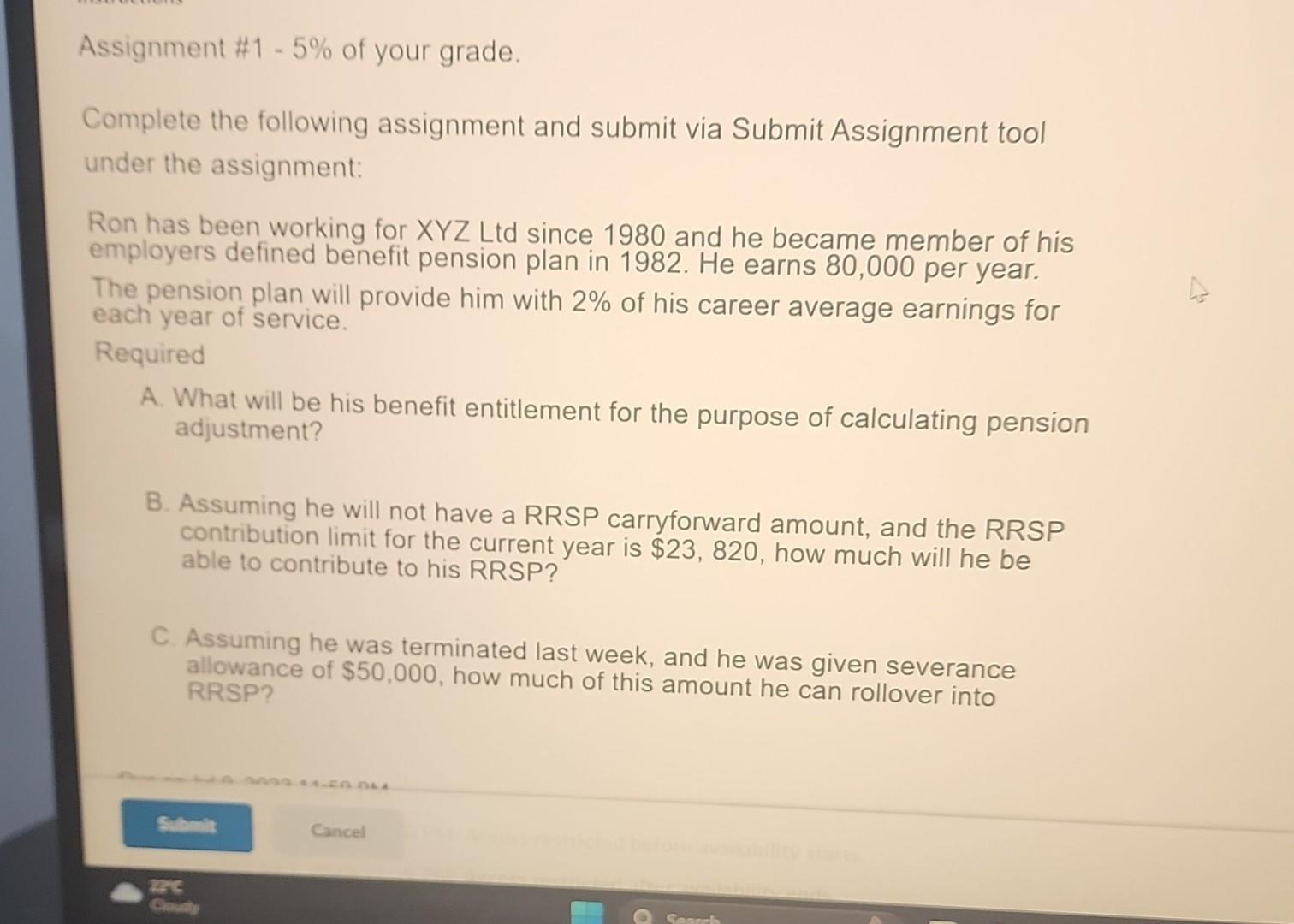

Assignment \#1 - 5% of your grade. Complete the following assignment and submit via Submit Assignment tool under the assignment: Ron has been working for XYZ Ltd since 1980 and he became member of his employers defined benefit pension plan in 1982 . He earns 80,000 per year. The pension plan will provide him with 2% of his career average earnings for each year of service. Required A. What will be his benefit entitlement for the purpose of calculating pension adjustment? B. Assuming he will not have a RRSP carryforward amount, and the RRSP contribution limit for the current year is $23,820, how much will he be able to contribute to his RRSP? Assuming he was terminated last week, and he was given severance allowance of $50,000, how much of this amount he can rollover into

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts