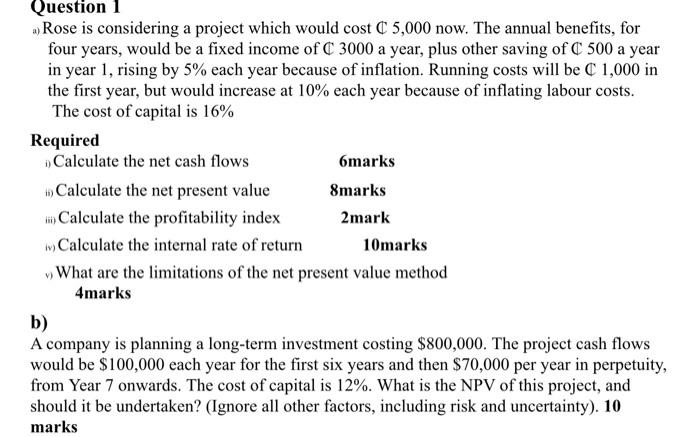

Question: a) Rose is considering a project which would cost C5,000 now. The annual benefits, for four years, would be a fixed income of C3000 a

a) Rose is considering a project which would cost C5,000 now. The annual benefits, for four years, would be a fixed income of C3000 a year, plus other saving of C500 a year in year 1 , rising by 5% each year because of inflation. Running costs will be C1,000 in the first year, but would increase at 10% each year because of inflating labour costs. The cost of capital is 16% v) What are the limitations of the net present value method 4marks b) A company is planning a long-term investment costing $800,000. The project cash flows would be $100,000 each year for the first six years and then $70,000 per year in perpetuity, from Year 7 onwards. The cost of capital is 12%. What is the NPV of this project, and should it be undertaken? (Ignore all other factors, including risk and uncertainty). 10 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts