Question: A s a t December 3 1 , 2 0 2 3 , Wildhorse Corporation i s having its financial statements audited for the first

December Wildhorse Corporation having its financial statements audited for the first time ever. The auditor has

found the following items that might have effect previous years.

Wildhorse purchased equipment January for $ that time, the equipment had estimated useful life

years, with $ residual value. The equipment depreciated a straightline basis. January

result additional information, the company determined that the equipment had a total useful life seven years with

$ residual value.

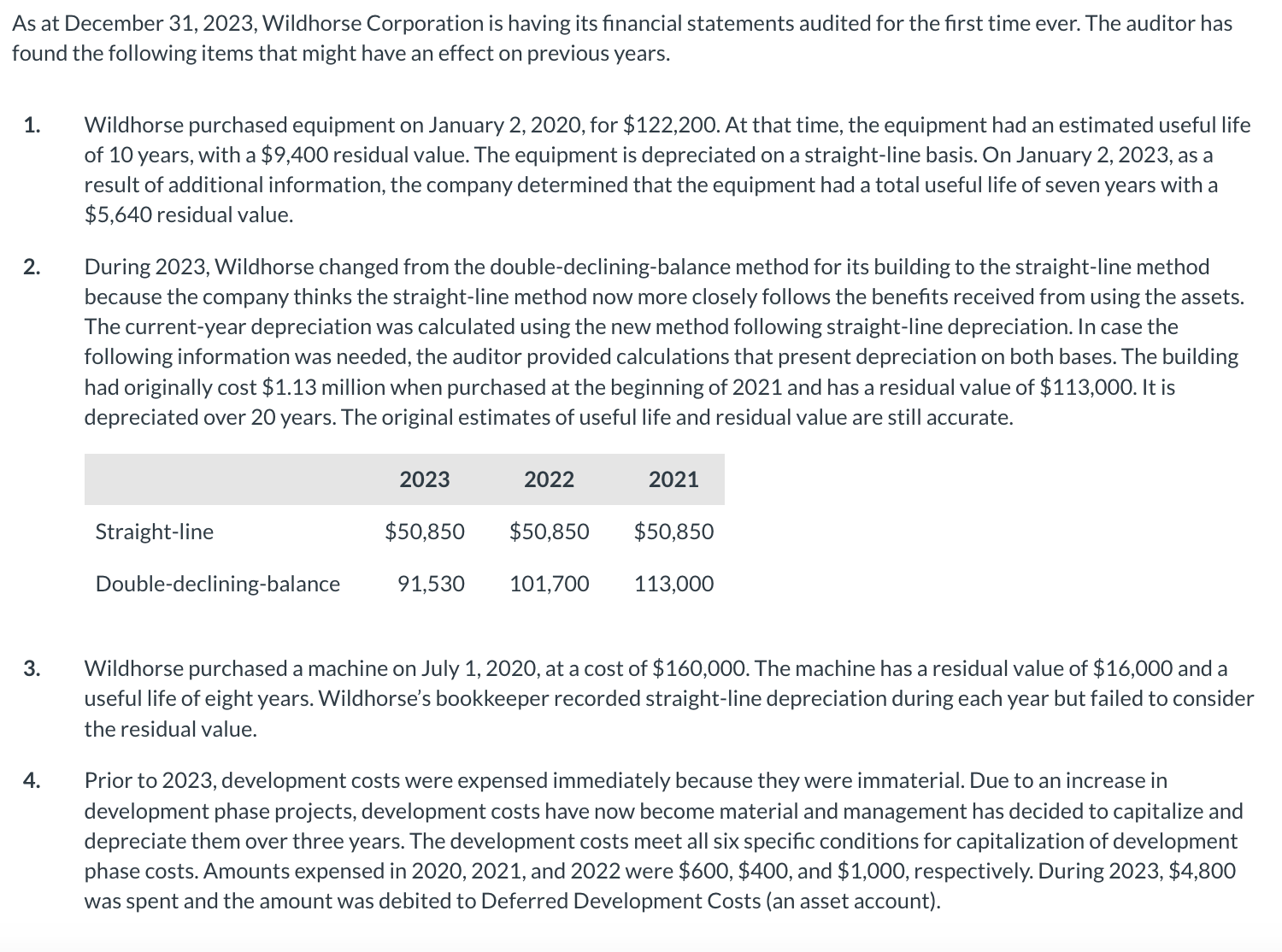

During Wildhorse changed from the doubledecliningbalance method for its building the straightline method

because the company thinks the straightline method now more closely follows the benefits received from using the assets.

The currentyear depreciation was calculated using the new method following straightline depreciation. case the

following information was needed, the auditor provided calculations that present depreciation both bases. The building

had originally cost $ million when purchased the beginning and has a residual value $

depreciated over years. The original estimates useful life and residual value are still accurate.

Wildhorse purchased a machine July a cost $ The machine has a residual value $ and

useful life eight years. Wildhorse's bookkeeper recorded straightline depreciation during each year but failed consider

the residual value.

Prior development costs were expensed immediately because they were immaterial. Due increase

development phase projects, development costs have now become material and management has decided capitalize and

depreciate them over three years. The development costs meet all six specific conditions for capitalization development

phase costs. Amounts expensed and were $$ and $ respectively. During $

was spent and the amount was debited Deferred Development Costs asset account Prepare the necessary journal entries record each the changes errors. The books for have been adjusted but not

closed. Ignore income tax effects. all debit entries before credit entries. Round answers decimal places, Credit

account titles are automatically indented when the amount entered. not indent manually. entry required, select Entry" for

the account titles and enter for the amounts.

Account Titles and Explanation

Debit

Credit

Entry

Accumulated Depreciation Machinery

Retained Earnings

Depreciation Expense

Amortization Expense

Deferred Development Costs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock