Question: a. Sampson Co. sold merchandise to Batson Co. on account, $34,200, terms 2/15, net 45. b. The cost of the goods sold is $25,650. c.

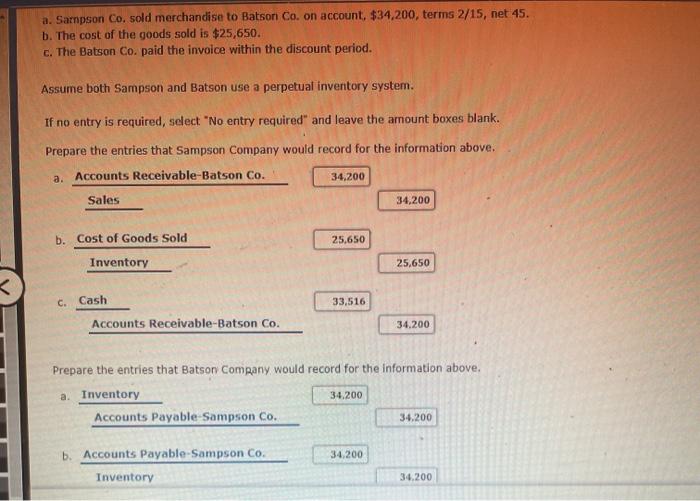

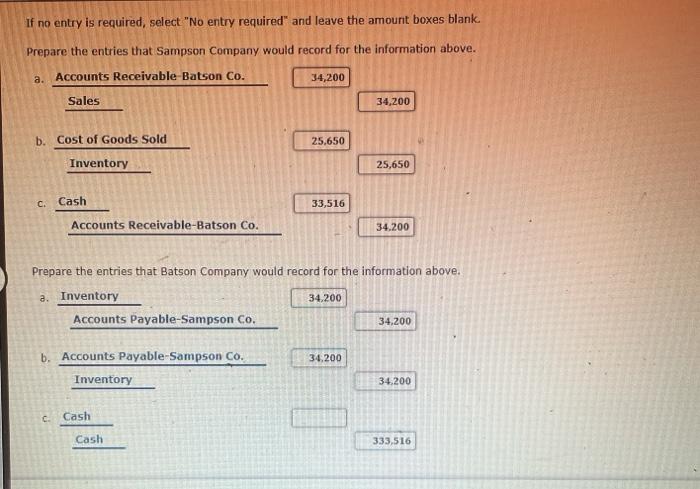

a. Sampson Co. sold merchandise to Batson Co. on account, $34,200, terms 2/15, net 45. b. The cost of the goods sold is $25,650. c. The Batson Co. paid the invoice within the discount period. Assume both Sampson and Batson use a perpetual inventory system. If no entry is required, select "No entry required" and leave the amount boxes blank. Prepare the entries that Sampson Company would record for the information above. a. Accounts Receivable-Batson Co. 34,200 Sales 34,200 b. Cost of Goods Sold 25.650 Inventory 25,650 C. Cash 33,516 Accounts Receivable-Batson Co. 34.200 Prepare the entries that Batson Company would record for the information above. a. Inventory Accounts Payable Sampson Co. 34,200 34.200 b. Accounts Payable-Sampson Co. 34,200 Inventory 34,200 If no entry is required, select "No entry required" and leave the amount boxes blank Prepare the entries that Sampson Company would record for the information above. a. Accounts Receivable Batson Co. 34,200 Sales 34,200 b. Cost of Goods Sold 25,650 Inventory 25,650 C. Cash 33,516 Accounts Receivable-Batson Co. 34.200 Prepare the entries that Batson Company would record for the information above. a. Inventory 34,200 Accounts Payable-Sampson Co. 34,200 34,200 b. Accounts Payable-Sampson Co. Inventory 34.200 C Cash Cash 333,516

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts