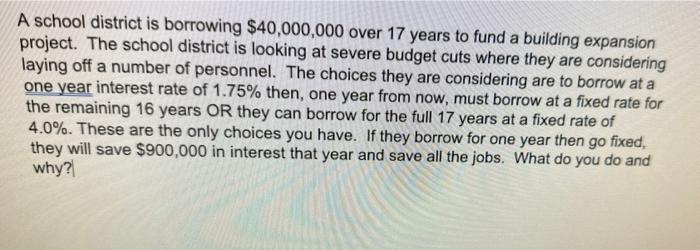

Question: A school district is borrowing $40,000,000 over 17 years to fund a building expansion project. The school district is looking at severe budget cuts

A school district is borrowing $40,000,000 over 17 years to fund a building expansion project. The school district is looking at severe budget cuts where they are considering laying off a number of personnel. The choices they are considering are to borrow at a one year interest rate of 1.75% then, one year from now, must borrow at a fixed rate for the remaining 16 years OR they can borrow for the full 17 years at a fixed rate of 4.0%. These are the only choices you have. If they borrow for one year then go fixed, they will save $900,000 in interest that year and save all the jobs. What do you do and why?

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

To make a decision in this scenario we need to compare the costs and benefits of the two borrowing o... View full answer

Get step-by-step solutions from verified subject matter experts